Within the space of just a few years, several new retinal treatments have been approved for wet age-related macular degeneration, diabetic macular edema and retinal vein occlusion, promising increased durability and better drying. These toolbox additions are encouraging for treating resistant and newly diagnosed patients.

As with any newly available treatment, uptake is often gradual, and doctors may wonder whether it’s worth it to stock another drug. Here, retina specialists share how these new drugs are performing in the clinic, and which investigational treatments show promise.

|

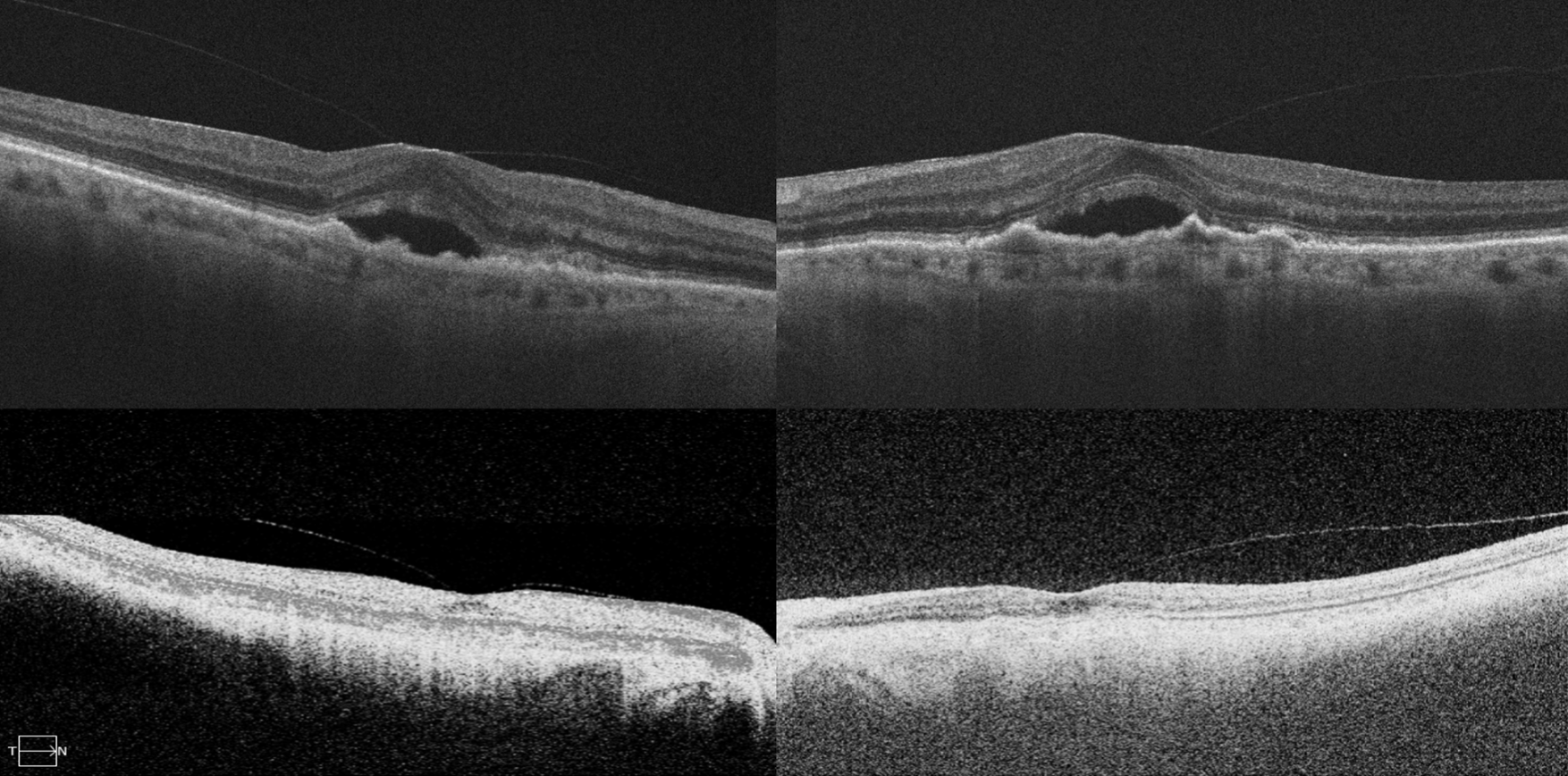

| Figure. OCT scans of both eyes of a patient with wet AMD who was on six-to-eight-week intravitreal injections for three years with persistent fluid (top row) and then underwent intravitreal faricimab. OCT scans (bottom row) show significant response after single intravitreal faricimab with resolution of long-standing subretinal fluid. (Courtesy Jay Chablani, MD). |

Bi-specific Durability

Faricimab-svoa’s (Vabysmo, Genentech) uptake has been increasing since its FDA approval in 2022 as retina specialists become more familiar with the new drug and its durability. Faricimab blocks both VEGF-A and Ang-2 to reduce further inflammation and vascular leakage by stabilizing blood vessels.

“The clinical trials for both wet AMD and DME imply that faricimab works at least as well visually and appears to dry a little bit better and faster than older drugs,” says Carl Regillo, MD, chief of the retina service at Wills Eye Hospital in Philadelphia. “For some patients, this can translate into better outcomes. Faricimab looks to be more durable and longer lasting, and we’re seeing this as we switch patients on older or first-generation anti-VEGFs to faricimab.”

Experts say this drug can be used as a first-line treatment and in patients who are resistant or difficult to treat. “I’d like to use it more often as a first-line option, but the reality is that there are usually payer issues that mandate the use of older drugs first, typically bevacizumab-first policies,” Dr. Regillo says. “Then, they mandate using ranibizumab or aflibercept before I can get to faricimab. So, usually there are a lot of logistics in dealing with payer reimbursement that holds up utilization of the newer drugs in general.”

David S. Boyer, MD, of Retina-Vitreous Associates Medical Group in Los Angeles, says he’s had “a mixed experience” with faricimab. “I was able to dry some patients better and extend others a bit longer. Then I have some patients in which it didn’t seem to make much of a difference, and I went back to the previous treatment paradigm I was using, which was usually Eylea at that point.”

“We started switching some of our patients who’d been on aflibercept for many years to faricimab, as well as some of our resistant patients,” says Jay Chhablani, MD, a professor of ophthalmology at the University of Pittsburgh School of Medicine. “I also offer faricimab to my naïve cases. I’ve seen many patients with good response (Figure). Some of the patients who were resistant to other drugs are able to be maintained on monthly faricimab. Others have been switched to every three or four months.”

Dr. Chhablani uses a combination of telemedicine and office visits to follow newly switched faricimab patients. “If I see that after one or two injections the response is good, I may incorporate some telemedicine visits,” he says. “Since they’ve switched to a new drug, I don’t know what the exact treatment-free interval could be, so in these patients, I tell them, ‘Your response is really good, so I’m skipping your injection today, but I’d like to get an OCT and telemedicine in four weeks.’ This gives me the confidence of not doing the shot but at the same time keeping a close watch for any early recurrence. Once we show that the patient does well at, say, 12 weeks, I’ll push their next visit to four weeks with a telemedicine visit and pushing the maximum treatment free interval.

“These are the patients who were used to getting monthly injections,” he continues. “I don’t want to lose their confidence by having them feel as if they’re not being followed as often or taken care of as closely as before. Adding telemedicine is a nice combination where I can ensure they’re symptomatically stable but do less frequent injections. If there are any changes in vision or symptoms at their testing-only visit, then our technicians know to obtain fundus autofluorescence and fundus photographs and inform the provider immediately.”

The clinical trials and real-world experience so far have shown that faricimab’s safety profile is comparable to that of ranibizumab or aflibercept. “No unique adverse events were associated with faricimab, and its safety profile is similar to what we’ve been using,” Dr. Regillo says. “It’s very well tolerated.” Extension studies AVONELLE-X (NCT04777201, n=1,036) and RHONE-X (NCT04432831, n=1,479) for wet AMD and DME, respectively, are ongoing to assess long-term safety and tolerability.

Biosimilars

Ranibizumab biosimilars have had a slow uptake with the availability of newer, more durable drugs like faricimab, and the tried-and-true original anti-VEGFs, but experts say biosimilar use will likely expand as payers incorporate it into step therapy. Ranibizumab-nuna (Byooviz, Biogen) and ranibizumab-eqrn (Cimerli, Coherus Biosciences) have both been available in the United States since 2022, though only ranibizumab-eqrn is considered interchangeable with Lucentis.

“Biosimilars don’t offer any clinical advantage over the reference products,” Dr. Regillo says. “The only reason to use them would be for some cost savings, and that’s usually savings by the payer. Some payers may mandate the use of a biosimilar, or if a patient has to pay out of pocket, they might prefer something that costs less. That’s pretty unusual for a patient to have to bear the full cost of these drugs, but it can occasionally happen.”

Dr. Chhablani agrees that biosimilar uptake will likely come less from the provider’s side and more from the payer’s. “I believe the payers are going to push us to bill for biosimilars, since the cost is going to be cheaper compared with the original molecules,” he says. “How much time will it take to get to this point, where we’re not using the original molecule but using biosimilars? I think biosimilars have some place but considering there’s so many new drugs available and coming soon, I think they’ll have a tough time.”

Dr. Boyer points out that fewer patients are on Lucentis nowadays, with Eylea and Vabysmo available. “There are only so many things you can carry in your refrigerator,” says Dr. Boyer. “If you carry Lucentis, Vabysmo, Eylea and Avastin, there’s limited space available for biosimilars. Now, this may change when aflibercept biosimilars come out, as retinal specialists are very familiar with aflibercept and use it frequently.”

Aflibercept biosimilars in Phase III include SOK583A1 (Sandoz), CT-P42 (Celltrion Healthcare), ALT-L9 (Alteogen).

Another ranibizumab biosimilar may appear in the armamentarium in the coming years. The supplemental Biologics License Application for XSB-001 (Xlucane, Xbrane Biopharma) was accepted by the FDA on June 21, 2023. Its Biosimilar User Fee Amendment goal date is April 21, 2024.

“I think there will eventually be acceptance of biosimilars,” Dr. Chhablani says. “Oncology is totally based on biosimilars, and they’ve been using biosimilars for years. I think it’s probably time that we also accept this as a way to treat our patients.”

Suprachoroidal Injection

In 2021, the FDA approved the first suprachoroidal triamcinolone acetonide injectable suspension (Xipere, Clearside Biomedical/Bausch + Lomb) for macular edema associated with uveitis. Dr. Chhablani says, “Xipere has been performing well in many of our patients. We have yet to see the long-term results, but the short-term results are promising. I’ve seen patients go up to four or five months so far.”

“The Xipere injection has a short learning curve, and it’s not a difficult injection to give though it’s a little more cumbersome than others to draw up and inject if you’re not used to doing those,” says Dr. Boyer. “Fortunately, I was involved in studies that used that technique. It’s fairly comfortable for patients.”

The company offers training with its suprachoroidal space microinjector. The training includes a kit with a practice syringe and a synthetic eye.

Brolucizumab in Reserve

Brolucizumab-dbll (Beovu, Novartis) is a humanized monoclonal single-chain variable fragment that inhibits VEGF-A to decrease neovascularization. It received FDA approval for wet AMD in 2019 and for DME in 2022.

“Brolucizumab doesn’t get as much use because its safety profile isn’t as good as all the other agents we’ve been using or those recently approved,” explains Dr. Regillo. “It has high rates of intraocular inflammation and some unique adverse events such as a retinal vasculitis and vasculitis-related retinal occlusions. That’s not something we’ve seen with other anti-VEGFs or faricimab to date. These added safety concerns have considerably held back brolucizumab’s uptake and utilization since its FDA approval.”

Some retinal specialists say they don’t use brolucizumab at all, others only in rare circumstances. Dr. Boyer says that brolucizumab was the strongest drug he’d ever used, but it’s the last one he would consider using due to the safety profile. “It dried phenomenally well and worked in patients whom I couldn’t dry at all before,” he says. “But, because of its vision-threatening side effects, it’s reserved for patients who are very difficult to treat. I’m down to one patient on brolucizumab who’s previously failed every other anti-VEGF treatment. So unfortunately, it’s a great drug but its side effect profile limits its use to rare cases. I’d call this a fourth-line drug, especially in view of faricimab’s improvement in overall drying.”

As with any anti-VEGF drug, patients on brolucizumab should be followed carefully for any signs of inflammation, especially after the first few treatments, Dr. Regillo says. “If there’s any inflammation, the drug shouldn’t be used. It could very well be that if a patient has any inflammation, they’re more inclined to get more inflammation, which could have a severe effect if the drug is reintroduced.”

High-dose Aflibercept

Aflibercept 8 mg is a novel intravitreal formulation in a 70 µL injection (114.3 mg/mL) that delivers a four-times higher molar dose compared with aflibercept 2 mg. This increased dose is hypothesized to provide longer effective vitreal concentration and more sustained effect VEGF signaling.

Retina specialists will have to wait a bit longer for the much-anticipated aflibercept 8 mg. In late June, due to dissatisfactory inspection findings at a third-party filler, the 8-mg dose’s approval was postponed. Fortunately, no issues were found with aflibercept 8 mg’s clinical efficacy, safety, trial design, labeling or manufacturing, and the FDA requested no additional data.

“High-dose aflibercept has demonstrated longer durability and some better drying in its Phase III studies for wet AMD and DME,” Dr. Regillo says. “It seems it would offer similar benefits to what faricimab has provided thus far. Its FDA approval is expected for both indications in the very near future. Once that happens, it will be another good option for our patients.”

In late June, Regeneron also released top-line, two-year data from the pivotal PHOTON trial for DME. Patients in the trial were randomized to either 12-week (n=328) or 16-week (n=163) dosing intervals after three initial monthly doses, with dosing flexibility if certain criteria were met, or aflibercept 2 mg dosed every eight weeks (n=167). The company reports that 89 percent of patients maintained ≥12-week dosing throughout the two-year period; 83 percent maintained ≥16-week dosing; and 43 percent met criteria for ≥20-week dosing by week 96.

Compared with the on-label regimen, aflibercept 8 mg dosed every 12 or 16 weeks reduced the mean number of injections at two years (13.8 injections vs. 9.5 and 7.8 injections, respectively). Mean BVCA improvement was comparable among the on-label and the 12- and 16-week high-dose regimens (8.4-, 8.8- and 7.5-letter gains, respectively).

Safety data consistent with that of aflibercept 2 mg were reported. The most common ocular adverse events were cataract, vitreous floaters and conjunctival hemorrhage. No cases of retinal vasculitis, occlusive retinitis or endophthalmitis occurred. The intraocular inflammation rate was 1.2 percent for both 2-mg and 8-mg groups.

In the one-year data from the PULSAR trial for wet AMD, 79 percent of 316 patients maintained 12-week dosing and 77 percent of 312 patients maintained 16-week dosing. BCVA was non-inferior to aflibercept 2 mg. At one year, patients receiving on-label aflibercept received an average of 6.9 injections, compared with 6.1 and 5.2 injections for 12- and 16-week dosing, respectively.

Additionally, 69 percent of 8-mg patients were without central subfield fluid at one year, compared with 59 percent of 2-mg patients. A fluid-free central subfield was achieved at a median of eight weeks for on-label patients and four weeks for 8-mg patients. Safety was consistent with the 2-mg dose. Two-year PULSAR data for aflibercept 8 mg for wet AMD is expected in the third quarter of 2023.

Dr. Regillo speculates that when it’s first introduced, high-dose aflibercept will experience a gradual adoption over time, like faricimab. “I think that as retina specialists get familiar with the drug and test the waters, if you will, they’ll start using it for a combination of both established and new-onset wet AMD and DME,” he says.

“One question will be whether retina specialists switch from aflibercept 2 mg to high-dose aflibercept or faricimab,” notes Dr. Chhablani. “Some may want to switch resistant patients to a different molecule rather than inject the same molecule. There may also be patients who don’t respond to faricimab whom we might consider offering high-dose aflibercept.”

“Cost makes a big difference,” says Dr. Boyer. “I don’t know what the company will do with the 2-mg dose, especially in light of the fact that aflibercept 2-mg biosimilars will be coming out soon. I’d say that depending on the cost of the biosimilar and the cost of 8-mg dose, there may be some insurance plans that would keep patients on the 2-mg dose rather than go up to the 8-mg dose. That will just have to play out in the marketplace.”

Retinal specialists are hopeful about the 8 mg’s increased durability but note that the real-world interval may be slightly shorter. “Whenever you do a clinical trial, your goal is to ensure you’re not leaving vision on the table compared to the comparators available at the time,” Dr. Boyer says. “There’s always rescue criteria for some degree of fluid or degree of loss, or a combination has to be met before retreatment. In retinal specialists’ hands, we usually don’t tolerate any fluid. So, I think we won’t be able to extend it as far as the ads say, just as I’m not getting faricimab as far out as the advertisements say because I don’t tolerate any fluid in the treatment of wet AMD or diabetic retinopathy. I do think aflibercept 8 mg will somewhat extend the treatment interval, but to what degree, we don’t know yet.”

What’s in Phase III?

Here is an overview of some potential new treatments coming down the pipeline:

• OCS-01 (Oculis). The first noninvasive treatment for DME may be coming in the next few years with Oculis’ investigational dexamethasone eyedrops. In the Phase III DIAbetic Macular edema patients ON a Drop (DIAMOND) study, patients were randomized 2:1 to OCS-01 (n=100) or vehicle (n=48) six times daily for a six-week loading phase and three times daily for a six-week maintenance phase. Topline results from stage one of the study showed a statistically significant increase in visual acuity at week six compared with vehicle (7.2 vs 3.1 letters, p=0.007), which lasted out to week 12 (7.6 vs 3.7 letters, p=0.016). More patients achieved a ≥15-letter gain (27.4 percent vs 7.5 percent at week 12, p=0.009) and improvements in retinal thickness (-61.6 µm vs -16 µm at week 12, p=0.004) compared with vehicle. No unexpected adverse events were observed. Stage two of DIAMOND, expected to begin in the second half of 2023, will include two global trials, each enrolling approximately 350 to 450 patients.

“The Phase II studies showed good results vs. Lucentis,” Dr. Chhablani says. “There will be some criticism about a Lucentis comparator, since more patients are started on Eylea for DME now, but if it works out then this delivery method could be a very good step forward for many diseases. One important thing to consider is how retina specialists would accept this option, as a combination with intravitreal therapy as maintenance or as primary therapy.”

• OPT-302 (Opthea). OPT-302 is a first-in-class, highly specific VEGF-C/-D “trap” molecule in development for wet AMD, to be used in conjunction with ranibizumab. It’s received fast-track designation from the FDA.

Dr. Boyer points out, “it’s two injections given at the same time, which is a bit less convenient than one injection,” but he adds that this new molecule could help address the problem of tachyphylaxis experienced by some patients, where a drug works well for a while and then suddenly its effects wear off.

“Tachyphylaxis may be secondary to upregulation of VEGF-C in humans,” he explains.

In the Phase IIb trial (n=366), OPT-302 + ranibizumab demonstrated statistically significant gains in BCVA from baseline to week 24 compared with ranibizumab monotherapy (16.1 vs 10.3 letters, p=0.0002). Currently, Opthea is running two Phase III registration trials of intravitreal OPT-302 2 mg, used in combination with 0.5 mg ranibizumab or 2 mg aflibercept at different intervals, ShORe (NCT04757610, n=990) and COAST (NCT04757636, n=990), respectively.

• HLX04-O (Shanghai Henlius Biotech/Essex). Shanghai Henlius Biotech and Essex have developed an ophthalmic version of their bevacizumab biosimilar (HLX04 [Hanbeitai]), HXL04-O for wet AMD. HLX04-O 1.25 mg/0.05 ml every four weeks was well tolerated in the Phase I/II trial (NCT04993352). In February, the first U.S. patient was dosed in the global Phase III trial (NCT04740671), which compares the efficacy and safety of HLX04-O with ranibizumab. Patients are randomized 1:1 to receive either HLX04-O 1.25 mg or ranibizumab 0.5 mg every four weeks for 48 weeks. The primary outcome measure is mean change from baseline in BCVA at 36 weeks.

• ONS-5010/Lytenava (Outlook Therapeutics). ONS-5010 (bevacizumab-vikg) is an investigational formulation of bevacizumab in development for treating wet AMD and other retinal diseases. In October 2022, the FDA accepted filing for a Biologics License Application for wet AMD. The Prescription User Fee Act goal date is August 29, 2023.

The Phase III NORSE II trial (NCT03834753, n=288) assessed the safety and efficacy of ONS-5010 dosed monthly compared with ranibizumab dosed on-label. All primary and secondary endpoints were met: 41.7 percent of patients gained ≥15 letters of vision (p=0.0052); 56.5 percent of patients ≥10 letters of vision (p=0.0016) and 68.5 percent gained ≥5 letters (p=0.0116), respectively. An additional secondary endpoint of mean change in BCVA from baseline to month 11 showed an 11.2-letter gain with ONS-5010 compared with a 5.8-letter gain with ranibizumab (p=0.0043). ONS-5010 was well tolerated, with only one ocular inflammatory adverse event occurring in NORSE II and none in NORSE I (a clinical experience trial, n=61) or NORSE III (an open-label safety study for BLA submission [NCT04516278], n=197).

“This is going to be an exciting option,” says Dr. Chhablani, “but much will depend on whether the company is able to bring the cost close to the off-label one. If it’s going to be more expensive, then I doubt we would switch, especially when we already have such strong safety data for off-label bevacizumab spanning more than two decades.”

• KSI-301 (Kodiak Sciences). KSI-301 (tarcocimab tedromer) is an anti-VEGF biopolymer conjugate in development for DME, DR, wet AMD and RVO that blocks all VEGF-A isoforms.

The Phase III BEACON study (NCT04592419, n=568) for RVO met its primary endpoint of noninferiority in mean change in BCVA, with KSI-301 dosed every eight weeks versus aflibercept dosed every four weeks in BRVO and all RVO patients. Kodiak says KSI-301 is the first anti-VEGF agent that’s demonstrated comparable visual acuity outcomes to monthly aflibercept with half the doses. BEACON reported low rates of intraocular inflammation and no cases of intraocular inflammation with vasculitis or vascular occlusion.

Several other Phase III trials are underway with topline results expected mid 2023, as of this writing: GLEAM (NCT04611152, n=450) and GLIMMER (NCT04603937, n=450) for DME; GLOW (NCT05066230, n=253) for DR; and DAYLIGHT (NCT04964089, n=557) for wet AMD.

Dr. Boyer is a consultant for Regeneron, Genentech/Roche, Oculis SA, Opthea, Novartis, Bausch + Lomb and EyePoint. Dr. Regillo is a consultant for Regeneron, Genentech/Roche, Kodiak, Novartis, EyePoint and Ocular Therapeutix. Dr. Chhablani has no financial relationships with products mentioned in this article.