The presbyopia marketplace is growing, but physicians and patients aren’t satisfied with some of the latest advancements in presbyopic treatments. Allergan offers the first presbyopia-correcting eye drop in the market, Vuity, and yet prescriptions have been trailing off since its release. Why is Vuity struggling to satisfy patients, and how can the pharmaceutical market bounce back?

|

John Hovanesian, MD, an ophthalmologist at Harvard Eye Associates in Laguna Hills, California, explains why Vuity struggled to meet the needs of presbyopic patients. “Two factors that are responsible for it’s less-than-expected performance: One factor is that there are side effects that patients are less prepared for than most of us expected. It’s not unusual to have a headache or pain in patients especially at the beginning of the dosing regimen,” he says. “Patients have to take it for a period of time before they may overcome that, and most do, but it can be a surprise initially for patients, particularly if they’re unprepared for having those side effects.”

|

| Vuity is the only presbyopia-correcting eye drop available in the market. Patients can take it once-daily for six hours of near vision, or twice-daily for nine hours. The second dose should be administered after six hours if needed. (Courtesy Allergan). |

For the Phase III VIRGO trial, Allergan reported that 14.04 percent of participants in the Vuity group (n=114) experienced adverse effects such as eye irritation and headache, as opposed to 3.45 percent of participants in the vehicle group (n=116) who experienced similar effects.

“Second,” Dr. Hovanesian continues, “I think that doctors prescribing these drops often may not always take time to prepare their patients for those side effects and everything involved. Every treatment has its limitations, but if we don’t prepare patients for these, they may not have the best experience, and that can affect our readiness to prescribe the treatment again. Additionally, there’s no financial incentive for doctors to recommend an eye drop for presbyopia. That doesn’t mean they won’t prescribe it, but the enthusiasm with which they prescribe it is not going to be the same as it would for, say, a drop for glaucoma that’s potentially going to save the patient’s sight.”

Gil Kliman, MD, an ophthalmologist and managing partner at InterWest, a health care investment firm, is the co-founder and program director of Eyecelerator. During a presentation in 2021, Dr. Kliman provided the statistics for the most likely blockbuster product advancement for ophthalmic innovation. According to an Eyecelerator poll from industry and physicians, 40.6 percent of participants (n=105) agree that the first FDA approval of pharmacological therapy for presbyopia was the greatest advancement.

“As an investor in the area at InterWest, we didn’t invest in any of the presbyopic companies initially. At first, we regretted that decision when we saw all the excitement around Allergan. Now, we’re glad to be on the sidelines watching how it’s going to play out and maybe get involved at a later point,” says Dr. Kliman. “It was seen as a positive that Allergan would have the first drug because they would develop the market and increase both patient and eye-care provider awareness, and then other companies could take advantage of that as kind of fast followers. That actually had the opposite effect, which was a surprise to everyone. The side effects of developing retinal detachments was unexpected. That wasn’t really seen as a major issue in the clinical trials by Allergan, and they did a very good trial of thousands of people.”

It’s unclear if Vuity is the direct cause, however. “Pilocarpine has in its labeling a warning that it can be associated with retinal tears or retinal detachment,” Dr. Hovanesian continues, “and there were a few cases of patients taking Vuity who developed retinal tears or detachments. It may not be fair to attribute those effects to pilocarpine. There’s no way to say that Vuity caused that.

“From a legal perspective, someone taking Vuity who has a detachment could blame the drug for it, and if they weren’t properly warned about that possibility, there could be liability questions for the doctors,” Dr. Hovanesian explains. “These few cases led to some doctors saying, ‘I don’t want to prescribe a drop that could land me in trouble because it’s associated with retinal detachment.’ Even if a retinal detachment had nothing to do with the drop, the risk is still a deterrent.”

Patient satisfaction and safety is leading to the issues in the presbyopia-correcting eye drop market, but understanding how to fit these drugs into the pharmacological space could potentially boost prescriptions. Dr. Kliman explains how companies and physicians should be approaching these products. “I think it’s a multichannel process because first companies have to get the providers comfortable with the idea that these are going to be good things to prescribe. And this is an interesting market in that it’s probably going to be primarily optometrically driven. Most people with presbyopia are probably going to see an optometrist first rather than an ophthalmologist if they’re just [plano presbyopes].”

Dr. Hovanesian notes that there’s a specific patient demographic who’ll receive favorable effects from presbyopic eye drops, including plano presbyopes. “Seems to me that the patients who probably do best with it are maybe around age 50 or older, those who definitely have presbyopia who don’t have much other refractive error, and those who are fully committed to glasses even if they can’t make it work another way. I have patients who are younger than that, or who aren’t affected as much by presbyopia, and they’re just not likely to commit to both the effort and the cost, because there’s also an out-of-pocket cost to use the medication.

“The patients who are significantly older than that often have cataracts playing a role, and if you have cataracts in the eye and you constrict the pupil, sometimes you can make the vision worse and not get the amount of depth of focus that you’d like to have,” continues Dr. Hovanesian. “Cataract and presbyopia are, sort of, part of the same process of maturing of the lens of the eye.”

Both Drs. Hovanesian and Kliman have some ideas on which products in the presbyopia-correcting drop pipeline seem promising. Dr. Kliman says, “The highest profile companies behind Allergan are Lenz Therapeutics, Visus Therapeutics and Orasis Pharmaceuticals. They’re all venture-capital backed, and they’re moving forward with a single product. I’m excited for them because they could have better efficacy and better side effect profiles than Vuity.”

Dr. Hovanesian agrees that products from Lenz Therapeutics and Visus are potentially promising. “Visus has a carbachol product, and Lenz Therapeutics has an aceclidine product, and those are different types of pupil constrictors,” he says. “They work by different mechanisms of action, and the companies hope that they’ll work better [than their competitors]. Visus combines their carbachol with brimonidine, which improves the longevity of the effect. It improves the efficacy of the carbachol, and they probably have the best clinical trial results for duration of effect of any of the companies, lasting out well past 12 hours, meaning most patients wouldn’t have to dose more than once a day with their product, Brimochol. However, they’re not approved, and we don’t know yet what the real-world side effect profile will look like.”

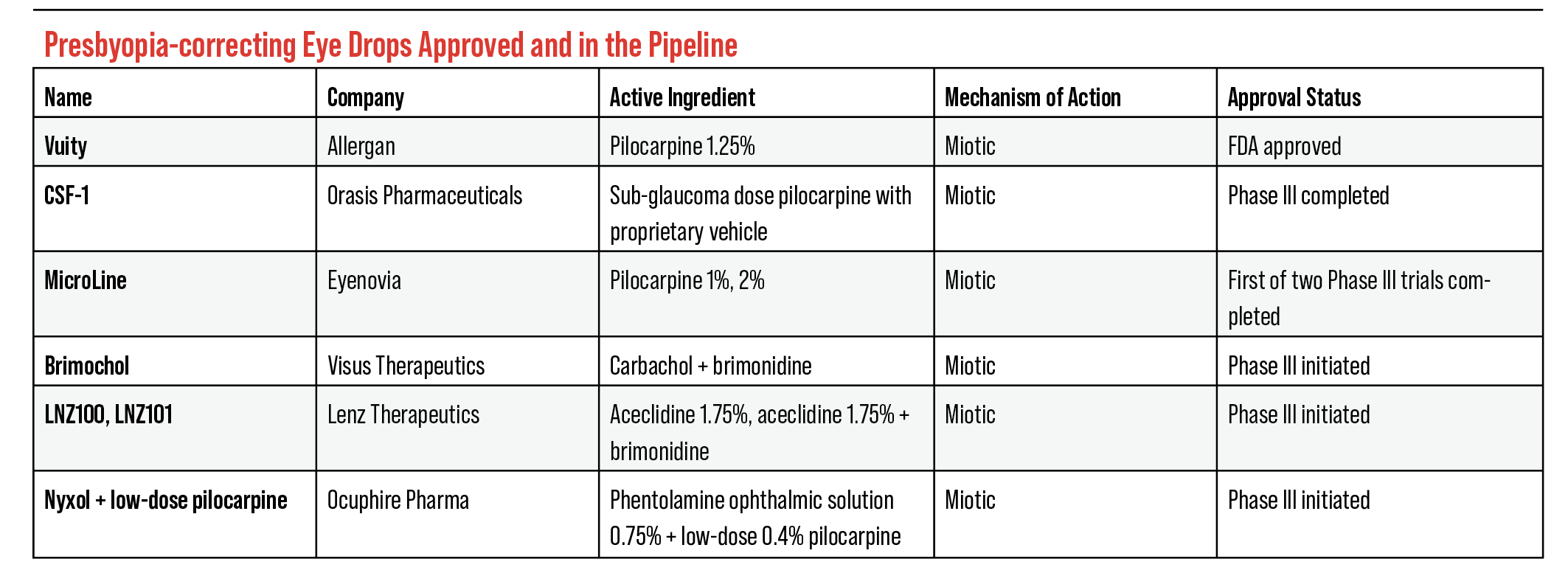

Current FDA Pipeline

There are five compounds in the FDA pipeline for presbyopia-correcting drops, each completing FDA trials for market release. “There can be more than one winner, which is important, because there’s a lot of entrants here in the market,” says Dr. Kliman. “So, it’s like a big horse race.”

Here are the eye drops in the pipeline currently:

• Brimochol (Visus Therapeutics). Carbachol and brimonidine tartrate make up the solution for Visus’ presbyopia-correcting eye drop, Brimochol. Visus explains that carbachol is a miotic agent that constricts the pupil, and brimonidine tartrate prevents the pupil from dilating. This reduces the pupil’s size and creates a pinhole effect similar to pilocarpine solutions. Visus uses brimonidine to potentially mitigate side effects from carbachol as well as increase the longevity of the solution.

Brimochol’s Phase III trials, BRIO-I and BRIO-II, are currently underway. In them, participants receive different compounds to assess the effects of the solution in Brimochol. Brimonidine tartrate, carbachol and Brimochol are all administered separately in different groups.

Recently, researchers from the BRIO-I trial for Brimochol presented topline data from their study: Brimochol successfully achieved the prespecified U.S. Food and Drug Administration primary endpoint based on the proportion of subjects achieving >15 ETDRS letter gain in binocular uncorrected near visual acuity without a loss of ≥5 letters at distance across all time points through hour six (carbachol p=0.006; brimonidine p=0.039). Also, Brimochol was reported to be well-tolerated by patients, showing no significant adverse effects. Phase III BRIO-II trial is still ongoing and Visus expects topline results by the second half of 2023.

As Dr. Hovanesian stated before, this product hasn’t completed FDA trials and physicians have to wait for a profile on the side effects after approval.

|

| LNZ100 and LNZ101 are the first and only eye drops in the pipeline to use the compound aceclidine. Like pilocarpine and carbachol, acecldine is a muscarinic agonist originally used to treat glaucoma. (Courtesy Lenz Therapeutics). |

• LNZ100/LNZ101 (Lenz Therapeutics). There are two eye drops in development from Lenz Therapeutics: LNZ100 and LNZ101. Both solutions include the compound aceclidine, but LNZ101 introduces brimonidine to improve the bioavailability of aceclidine. Lenz Therapeutics explains that aceclidine doesn’t overstimulate the ciliary muscle, provides a sub 2-mm pupil and avoids impacting distance vision. They also mention that LNZ101 has the added benefit of eye whitening.

Lenz’s Phase II INSIGHT trial met its primary endpoint of a ≥ three-line gain in near visual acuity without losing ≥ one-line of distance vision, with 71 percent (LNZ100) and 56 percent (LNZ101) of participants achieving this at one hour. The duration of both solutions was examined at 10 hours, which found 37 percent (LNZ100) and 48 percent (LNZ101) of participants achieving the primary endpoint. The secondary endpoint pushed for ≥ two-line gain in near visual acuity without losing ≥ one-line of distance, which 86 percent (LNZ100) and 78 percent (LNZ101) achieved this at one hour, and 55 percent and 58 percent at 10 hours.

• CSF-1 (Orasis Pharmaceuticals). In February, Orasis Pharmaceuticals announced that the FDA approved for review the NDA for CSF-1, the company’s 0.4% pilocarpine solution. The Phase III, NEAR-1 and NEAR-2 (n=613) trials’ primary endpoints attempted to find the percentage of participants with a ≥ three-line gain in DCNVA at 40 cm and no loss in BDCVA ≥ five letters at 4 m on the eighth day of the trial. The secondary endpoint attempted the same results on the first, eighth and 15th day of the trial.

According to Orasis, both trials met their primary and secondary endpoints on day eight. Forty percent and 50 percent of participants from the NEAR-1 and NEAR- 2 trials received a three-line gain in DCNVA with no loss of one line or more in BDCVA after one-hour post-dose. Participants achieved statistically significant three-line improvement on days one and 15. On Day 15, participants achieved statistically significant three-line or more improvement in DCNVA as early as 20 minutes and up to eight hours post-dose. Researchers reported that 6.8 percent and 5.8 percent of participants from the NEAR-1 and NEAR-2 trials experienced side effects such as headaches and eye irritation. Overall, 2.6 percent of participants reported moderate treatment-related adverse effects.

|

| Eyenovia is developing Optejet to include smart technology. It can connect with a smart device to track dosing and alert patients when they need a dose or refill. Eyenovia proposes the potential of sharing this information with a patient’s doctor to improve treatment decisions. (Courtesy Eyenovia). |

• MicroLine (Eyenovia). Eyenovia offers 1% and 2% pilocarpine solutions that would be administered using their OpteJet dispenser. This product is meant to regulate the dispensing of their pilocarpine solution, MicroLine. Eyenovia notes that traditional eye drops are approximately 40 µL in volume, which exceed the absorption capacity of the eye. OpteJet dispenses an 8 µL dose of medication, which is the approximate absorption capacity of the eye. This dispenser is the driving force for Eyenovia’s latest drugs in the pipeline.

The Phase III, VISION-2 trial for MicroLine isn’t completed, but Eyenovia researchers completed the VISION-1 trial. The primary endpoint for the VISION-1 was to have a ≥ three-line gain in DCNVA at 45 cm after one-hour post-dose. Participants were administered MicroLine and a vehicle (placebo). Participants who received MicroLine reported improvement in their near vision as opposed to the vehicle group (2:1). The MicroLine group reported side effects such as moderate hyperemia, instillation discomfort, and brow ache, while zero participants in the vehicle group reported side effects. Eyenovia states that MicroLine improves vision for three to four hours.

• Nyxol (Ocuphire Pharmaceuticals). Ocuphire’s Nyxol is being developed for presbyopia as well as mydriasis and dim light vision disturbances. The presbyopia eye drops, unlike the products for mydriasis and DLD, are made up of 0.4% pilocarpine and 0.75% phentolamine. Nyxol is currently undergoing Phase III trials. Phase II trials for the presbyopia eye drops showed that Nyxol can sustain its effect for an 18-hour period. Pilocarpine is meant to reduce the pupil size along with the phentolamine. Ocuphire uses this compound to work alongside pilocarpine in order to relax muscles and reduce IOP.

“[Presbyopia-correcting eye drops] can change the future of treatment profoundly,” says Dr. Hovanesian. “We have drugs that the market recognizes are really improving lives. I’m still optimistic for the future of drugs like this. It has a large impact, and I would encourage my colleagues to consider and try each of these products as they become FDA approved. Give them a reasonable chance, educate patients properly, screen patients properly for who might have the best outcome, and give them a chance to succeed, because if they were approved in an FDA trial, then they probably have some value to patients.”

Drs. Hovanesian and Kliman have no financial interests to disclose.