Medicare spending dropped significantly in the first half of 2020. According to an American Medical Association analysis,1 ophthalmology as a specialty experienced the second largest cumulative reduction in Medicare Physician Fee Schedule spending compared to pre-pandemic levels. The 29-percent reduction translated to a cumulative drop of $766 million. Medicare spending approached expected amounts for the year by the end of June, but the economic impact was felt throughout ophthalmology. Now, as practices continue to recover from the pandemic, cuts to reimbursement loom on the horizon.

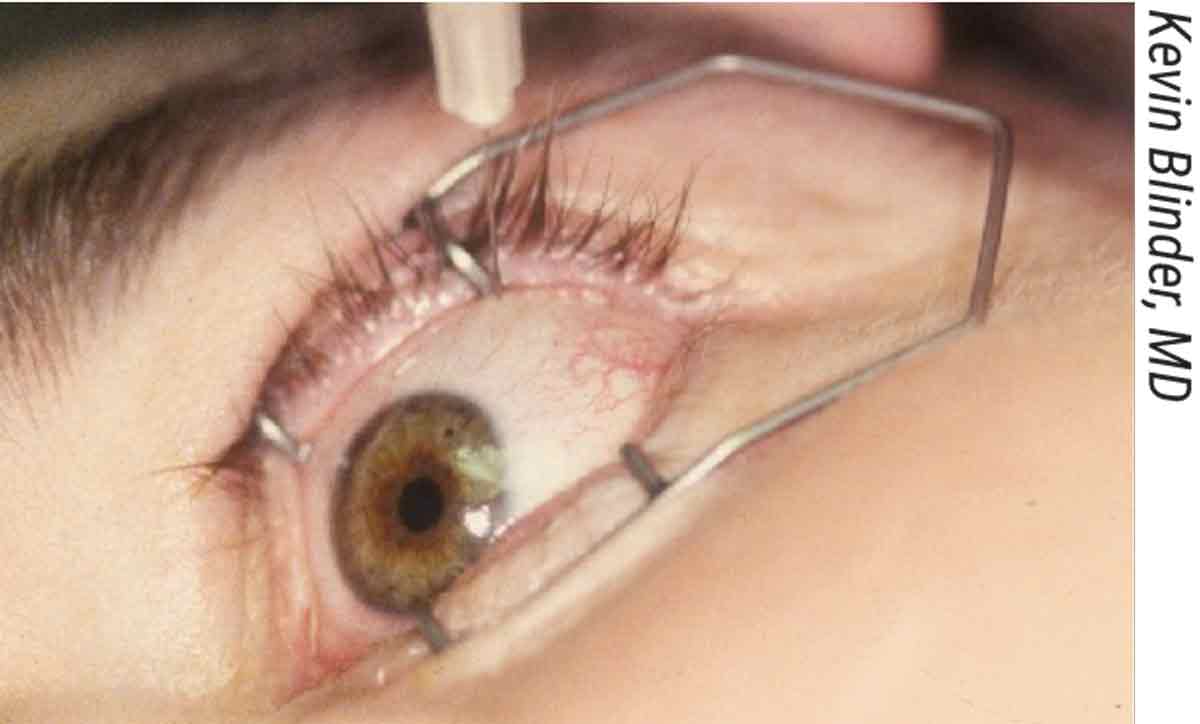

“Each year we go through the same stress and anxiety over possible Medicare cuts until we find out for sure what will actually be instituted for that year,” says Kevin Blinder, MD, of the Retina Institute in St. Louis. “We have yet to see a physician cost-of-living raise or increased reimbursement for our time. With that said, we have to adjust to the changes each year and strive to continue to provide our patients with the same excellence of care that they’re accustomed to. The challenge, of course, is to stay up-to-date with the ever-increasing technology in our field to continue providing cutting-edge care to our patients in light of the ever-decreasing reimbursement.”

|

| Ranibizumab and aflibercept costs made up 12 percent of the annual Medicare Part B budget, based on claims data from 2011 through 2015.3 |

“It’s a shame to see how deep the decline in reimbursements is, especially in cataract surgery,” says Y. Ralph Chu, MD, of the Chu Vision Institute in Bloomington, Minnesota. “I think the value that cataract surgery provides to society has been shown in many studies to be greater than what we currently value the surgery at. It’s important for ophthalmologists to understand and to keep fighting for our value in the system; to realize that this is a calling and that what we do is important beyond just helping people see. We’re really helping people live healthier, more productive lives in society. In fact, a study recently came out that showed cataract removal lowers an individual’s risk for developing dementia by 30 percent. That’s huge!”2

Fortunately, threats of fee cuts very rarely materialize in quite the same form that they initially arise, says John Pinto of J. Pinto & Associates in San Diego. “By the time proposals wade through the process, fees are often not reduced as expected,” he says. “There are profound political and industry forces, as well as professional societies lobbying, that more often than not reduce to some degree the impact of slated cuts. The sort of ‘run for the hills’ moment that some feel we’re at in the profession is really more an opportunity to harness any fear you might have, and be ready to take action if meaningful cuts are applied. This will obviously help you even more if the cuts are muted or don’t come.

“That said, all practices, at all times, should be undertaking an ongoing process to scan for missing profits,” he continues. “Undertaking a periodic profit enhancement review shouldn’t be something you do acutely in the wake of announced fee cuts. It should be something you’re aware of chronically as the owner or manager of a practice. It should be an enduring mindset.”

Here’s how some doctors are shoring up their practices to weather the cuts, even in the face of challenging pandemic conditions.

Cuts After COVID

Dr. Blinder says the two major cuts in the field of vitreoretinal care for 2022 are 67141 (in-office cryotherapy for retinal break) and 67145 (in-office laser photocoagulation for retinal break). “The cryopexy reimbursement has decreased by almost 50 percent and the laser retinopexy by almost 55 percent,” he explains. “These are two commonly used, in-office procedures in our practice that will certainly decrease our revenue this year and for years to come. The overhead for these procedures is not insignificant as well. Functioning cryo and laser units are required at each office.”

He says an instance of collateral damage has also resulted. “I was recently demoing a new single-use, disposable cryo probe that I had told the company has great potential for offices such as ours, with multiple locations and physicians,” he says. “The company had determined a price range for the product, based on production costs, R & D costs and a conservative profit margin. Unfortunately, given the recent cuts, the cost of the probe will potentially be more than the Medicare-allowed reimbursement. This is certainly an instance where the Medicare cuts can steer the R & D efforts of both companies and individuals.

“As the COVID-19 pandemic comes under control, we’re seeing more patients than ever, but doing so with what seems to be fewer and fewer personnel,” Dr. Blinder says. “We didn’t lay off any office personnel during the initial devastating outbreak of COVID-19, but we did lose some employees due to COVID infection, exposure and/or vaccine-related issues, family commitments and/or fear of being around people. As a result, in an attempt to retain the remaining personnel and keep our doors open, we’ve given raises and bonuses across the board a few times with a resultant increase in overhead.

“We’ve also had to purchase and maintain personal protective equipment as well as COVID testing kits,” he says. “For a while we were offering in-house vaccinations as well. All this takes time, funding and organization.

“We had a good outcome from COVID that’s worth pointing out,” he adds. “We had pre-COVID plans to enlarge our administrative/billing office. During COVID we encouraged most if not all employees that were nonclinical to work from home. We’ll maintain some of the workforce at home post-COVID to try to not increase, and possibly reduce, our overhead. I think some of the employees certainly don’t miss the commute to work and are happier working from home.”

Optimizing Billing

One clerical error or an incorrect prior authorization can lose you $1,000 or more. “Insurance companies are looking for reasons not to pay you, and your team has to be on top of it if you want to be paid properly,” says Ken Lord, MD, of Retina Associates of Southern Utah in St. George, Utah. “We maximize the opportunity to bill for the patient encounter, using the appropriate billing, procedure and drug codes so we get paid.”

You’ll never regret improving your billing processes or collecting payments at the time of the procedure, says Steven H. Dewey, MD, of Colorado Springs Eye Clinic. He made a significant billing change a few years ago. “My office manager was reconciling the surgeries I’d performed with the collected receipts and found that the insurance provider had reduced a couple comprehensive exams to intermediate,” he says. “My billing company hadn’t jumped on this, so we looked into other options. We went with a medical consulting group out of Springfield, Missouri, and our bottom line improved considerably. They really cleaned up the billing and coding.

“I think it’s worthwhile to have a consultant come in and take a look to make sure you’re being reimbursed for the services you’re providing, as opposed to being reimbursed for the services the insurance company thinks you’re providing (when you’re actually doing more),” he says.

Dr. Blinder’s practice recently purchased a new EHR system to help with overall practice efficiency and billing. “We’re anticipating better support with the new system and less downtime due to system failure,” he says. “The new system has been touted as a way to improve our overall efficiency and ability to see patients in a timely fashion, and it’s supposed to increase our coding/billing accuracy and allow us to maximize our reimbursement and profitability.”

|

| Doug Grayson, MD, and Christopher Quinn, OD, at Omni Eye Services, a private equity-backed practice in Iselin, NJ. |

“We’re also trying to maximize our study activities,” he continues. “We’re a very academically oriented practice that’s always been involved in studies with an active study department. However, we haven’t done our best to ensure we’re getting paid/reimbursed for all the study activity that we do. This is essentially lost revenue that we’re attempting to recapture.”

Doug Grayson, MD, of Omni Eye Services in Iselin, New Jersey, says his practice is attempting to collect more payments upfront and to educate patients about their deductibles and co-payments. “Deductibles are very high,” he says. “We don’t want someone showing up for cataract surgery and then being billed retroactively for the $1,500 that was their deductible and copay. We’re trying to get them to pay that up front. We don’t want to do their procedure and then have to chase after them to get the money.”

Fill Gaps in the Schedule

Seeing just one or two more patients per day can add a significant boost to your revenue. “I remember mentioning waiting lists to another doctor several years ago,” says Dr. Dewey. “He said, ‘You have a waiting list? We just have a long coffee break.’ The second we get the notification that someone has canceled, we’re on the phone calling somebody on the waiting list, and we keep calling until we find somebody to fill the spot.”

Maximize Facility Use

Dr. Blinder says his practice is in the process of rearranging office schedules to reduce dead time. “In the past, we had a very complicated schedule for accommodating 10 attendings and four fellows at 15 locations and four ORs,” he says. “Presently we’re attempting to simplify the schedule by minimizing half days, where a physician and the crew work in one office for the morning and another for the afternoon. By converting these days to full days at one office we can reduce or eliminate the pressure on all personnel to finish the morning on time in order to get to the next office without much delay. This also reduces the amount of travel time and travel reimbursement, the dead time between offices with loss of productivity, and might allow for an earlier end to the day, thus reducing overtime.”

Dr. Grayson reports re-evaluating and rearranging his ASC schedule. “We have surgeons who are looking for time because they’ve got more cases to do,” he says, “and then we’ve got people who are blocking up multiple hours doing 45-minute cataracts, so we’re phasing those out. We only have a fixed amount of time in the ASC when we can function.”

A vertically-integrated system where surgeons and optometrists practice at the top of their licenses can also help maximize practice efficiency, adds Dr. Chu. “A practice model that enables surgeons to focus on surgical cases and optometrists to focus on managing patients in the clinical setting can really help.”

Cost Sharing

When Dr. Dewey and some fellow ophthalmologists realized that none of them had optimum operating room facilities in the scattered facilities they were working at, it made sense for them to build essentially what became a medical condominium. “We have four separate practices under one roof,” says Dr. Dewey. “The sooner individual groups of physicians come together and build centers, the sooner they’ll benefit. The real estate aspect of owning your own building won’t immediately offset the impact of the cuts, but in the long term it’ll pay off. Paying rent to yourself makes a huge difference.”

Private equity is another option that can reduce some operational costs, according to proponents. Dr. Grayson says his practice is a private equity model and acquires other practices and integrates them to decrease expenses and increase revenue. “The administrative burden and HR department are shared, which reduces costs,” he notes. “We have an oculoplastics practice in our system as well. They’re increasing the cost of fillers and Botox procedures. While there are lots of spas that do those procedures too, we have the advantage of having oculoplastics specialists who can also do cosmetic lid surgery and any other cosmetic facial surgery around the eyes. The specialist recently boosted prices for lid surgery. Anything out of the insurance loop is helpful.”

Increased Volume and Hours

Unfortunately, given the pandemic, increasing patient volume and work hours don’t seem like viable options for many practices. “We’re just trying to increase volume to keep pace,” says Dr.

Grayson. “We’re trying to hire more doctors and see more patients, but it’s difficult to do now for a number of reasons. We’d like to increase our hours of operation, but it’s not been feasible. You can’t hire personnel, even at higher salary rates, to work nights and Saturdays these days because people have more lifestyle expectations. COVID probably made that more prominent. Staff don’t want to work past 6 p.m. They don’t want to have an evening shift at the ASC doing cases until nine or 10 o’clock, which we used to do back in the old days. It’s a big challenge to find and keep the right personnel.”

He says it’s also been challenging to hire ophthalmology associates. “They’re also more concerned about lifestyle considerations,” he says. “We used to have associates working Saturdays, nights, being on percentage and getting a percentage bonus, but now they care less about percentage and more about leaving at 5:30 p.m. and having six weeks of vacation every year. Productivity has changed dramatically. Sometimes you have to make do with less.”

“We have our core staff, but the new generation of technicians and mid-level staff are hard to keep around,” says Dr. Lord. “We offer benefits and money, but it doesn’t seem to matter. Our staff is our lifeblood. We try hard to keep them.”

Upgrading Equipment

“We’re running out of options to compensate for these large reimbursement cuts, but adding newer technologies can help,” Dr. Chu says. “Intraoperative guidance technologies and having refractive surgery technology available is a win-win for your patients, as well as a good revenue stream. There are many exciting developments in dry eye and glaucoma too, so if a practice hasn’t looked into expanding its treatment options and lines of service, that’s an avenue to investigate.”

Dr. Dewey agrees. “Make sure you have advanced technology and procedures available to your patients,” he says. “These procedures provide them with improved visual function.” He says he recently replaced his decade-old biometer with a new one and has noticed improved IOL calculation accuracy with the latest formulas. “It’s enabled me to increase my utilization of the Synergy lenses (Johnson & Johnson Vision) and multifocal IOLs. Offering more premium lenses has helped offset the cuts too, and there’s an increasing demand for these services anyway, with many more patients choosing to use their disposable income to get their cataract surgery done now.”

Offering Non-covered Services

Increasing your non-covered services, such as premium lenses, is a tried-and-true way to bump up revenue. “Premium lenses is the single biggest area where many practices aren’t nearly as involved as they could be,” Dr. Grayson says. “If you invest the time and energy, this is an easy way to increase your profits—and it’s good for patients.”

However, he cautions that it’s important to fully understand all the intricacies of the premium cataract business. “You need to invest the time to understand, learn and purchase the necessary equipment to do it really well and give your patients good results. You need Pentacam and a more sophisticated IOLMaster. You also need to be able to deal with the patients who don’t get optimal results and know how to correct them.”

Dr. Grayson’s practice is at maximum penetration for premium conversion. “The only reason a patient in our practice doesn’t get a multifocal or femto is that they have some medical contraindications where it wouldn’t be a good idea or they’re unable to do it financially,” he explains. “We have a very high rate of conversion in the face of decreased reimbursement. It’s good we’re doing so well with it, but it also doesn’t give us much room for expansion in this area.”

He says he considered raising the prices for premium lenses. “We might consider bumping it up a little bit,” he says, “but we don’t want to scare patients off because we’ve got a good conversion rate right now where patients feel comfortable with the amount of money they have to pay.”

If you don’t offer premium lenses, Dr. Grayson says, “Seeing more patients could be more lucrative than doing non-premium cataract surgery in the face of all the reimbursement cuts.”

In-office dry-eye procedures present another potential avenue for increased revenue. “We’re ramping up our use of intense pulsed light for dry-eye therapy,” says Dr. Dewey. “Now that the facial masking restrictions for COVID are being lifted, I have a feeling we’ll see more patients for these in-office treatments. There’s been hesitation among some about becoming morbidly ill because they would like their eyes to be more comfortable.”

“Patients really went for LipiFlow,” says Dr. Grayson. “But it takes a lot of time and effort. Are the $1,000 treatments really much better than tears and some steroids? It’s also possibly a less tangible benefit for the patient, compared to, say, cataract surgery, since dry eye is a chronic disease that requires repeated treatments.”

Know Your Norms

“It’s important to remember,” Mr. Pinto says, “that in a business such as ophthalmology—a service-based business with high fixed costs and a fair amount of control over the volume of business coming through—profit enhancement is much more a matter of revenue enhancement than cost containment. Cutting costs is usually the wrong approach.”

Experts say it’s hard to do a good job at profit enhancement without a deep understanding of practice norms or benchmarks, such as average revenue per patient visit. “This is analogous to medicine itself,” says Corinne Wohl, MHSA, COE, of C. Wohl & Associates in San Diego. “It’s hard for a doctor to help a patient get healthier unless the doctor has a pretty clear view of what ‘health’ looks like and what disease looks like. It’s incumbent on practice owners and practice managers to develop over time a memorized command of roughly 50 or so benchmarks that help one evaluate the state of a practice.”

If your practice has neglected an ongoing review of these business statistics, Mr. Pinto and Ms. Wohl recommend conducting a deep dive into the total organization and performing gap analysis. “Find out whether there’s a gap between the normative figures and your practice’s figures,” says Ms. Wohl. “Once you’ve done this deep dive, it’s important to repeat it at regular intervals—monthly for some stats, quarterly or annually for others. Look at the statistics and make sure you’re within norms.”

Here are some expense containment examples using the most common large expenses every practice has. “All of these expenses have their own normative benchmarks which you can compare your figures to to see whether you’re spending too much on them,” Ms. Wohl says.

• Staffing costs. “Staffing costs in a typical general ophthalmology setting make up about 30 percent of collections or revenue—i.e., for every dollar you bring into the practice, you’re spending about 30 cents on lay staffing costs,” she says. “This figure is a little lower in retina, around 25 percent of net cash flow. It tends to be a little bit higher in practices like pediatrics, where cash flow is not quite as strong per patient visit.”

• The amount of labor that goes into seeing each patient. In the typical general practice, about two-and-a-half lay staff hours are used for every patient visit, Mr. Pinto says. “That’s up and down the ranks: reception; techs; scribes; billing staff; administrators; and everyone else it takes to ensure the patient gets taken care of,” he notes. “If you had a practice with three or three-and-a-half lay staff hours per patient visit, you would probably be a bit overstaffed, and that would be an opportunity for cost containment.”

• Facility costs. “It’s a little harder to reduce costs in this area because they’re often locked in,” says Mr. Pinto. “The average general ophthalmology practice spends about five cents of every dollar it brings in for facilities—i.e., renting space or paying a mortgage, utilities and the like. Sometimes very young practices starting out with their first suite may spend 10 or 15 percent of their cash flow on facilities. This is obviously something baked into the cake at least for the duration of your lease. The only thing you can do to get the cost down as a percentage of cash flow is to get more cash flow itself, share facilities with compatible providers, negotiate a new lease or relocate when your lease is up.”

• Marketing costs. “Marketing costs are pretty wide-ranging,” Mr. Pinto points out. “They can be anything from about one to five percent of cash flow. If you have a busy, ambitious LASIK practice, you might have 10 cents or even more of every dollar coming in going right back out for marketing costs and be in a position where you have to keep that up if you want to keep your LASIK practice going.

“There’s an old saying in marketing that at any one time we’re wasting half of our marketing budget—we just don’t know which half,” he says. “It’s important to try to understand which of your marketing expenditures are actually working and which are wasted.”

Here are some options on the revenue enhancement side:

• Average ticket, or average revenue per patient visit. “In a general practice, this is about $200, sometimes a bit more,” Ms. Wohl says. “It can be somewhat higher than that in retina, and certainly much higher in elective plastics. Each practice has its own level for this. If you examine your benchmarks and find that your average ticket is lower than the typical figure—let’s say it was only $170—you might examine opportunities for providing more testing, if that was clinically indicated.”

She says that doing more surgery or more testing can shift a practice into a normative range. “When we go into some client practices, we might find only five percent of patient visits involve an OCT test,” she notes. “The typical figure is closer to 10 to 15 percent, or a bit higher. Or, we’ll go into a general practice and typically see that about five percent of patient visits have had a visual field exam. If we go into a practice where that figure is lower—two or three percent—when it should be closer to five percent or bit higher, then we know there’s a gap. We’ll have a discussion with the client about the care pathways in the practice. Are they not doing the testing because there’s not enough equipment? Not enough staff? Is the clinic floor so busy that people don’t have enough time to do the special testing and it gets endlessly delayed and pushed off until the next encounter?”

• The number of patient visits. The general ophthalmologist who’s working full time will typically be able to see about 500 or more patient visits per month, including postops, notes Ms. Wohl. “If a doctor’s seeing materially fewer than that, then profit enhancement will be a matter of getting those patient visit figures up,” she says.

• The practice’s surgical density. “Most general ophthalmologists report that they like to have a surgically-dense practice,” says Mr. Pinto. “The way we benchmark that is by asking, ‘How many visits do we need to see before we find a surgical case,’ like a cataract, for example. In the typical practice, you’ll find about 20 to 25 visits per surgical case. In a highly surgically dense practice, you may have only five or 10 visits per surgical case because, for example, the practice is a referral center getting optometric support, or they’re making a robust and effective marketing effort.

“Ultimately, even if this latest slate of cuts is profoundly deep, which might not be so surprising given the currently soaring federal debt and conflict in Europe, there may be a lot of voices calling for deeper cuts in entitlement programs,” Mr. Pinto says. “But ophthalmology is highly resistant. It’s important to remember that cataract fees, adjusted for inflation, have dropped more than 95 percent since the 1970s, and we’re still thriving in this profession. The industry is going to do just fine, regardless of the cuts. There are about 650 million eyeballs in America and an unquenchable demand to be able to see well through them. Well-prepared practices will do fine under all scenarios.”

Dr. Dewey is a consultant for Johnson & Johnson Surgical Vision. Drs. Chu, Blinder, Grayson and Lord report no relevant financial disclosures.

1. Gillis K. Policy research perspectives: Changes in Medicare physician spending during the COVID-19 pandemic. American Medical Association 2021. https://www.ama-assn.org/system/files/2021-03/prp-covid-19-medicare-physician-spending.pdf. Accessed March 9, 2022.

2. Lee CS, et al. Association between cataract extraction and development of dementia. JAMA Internal Medicine 2022;182:2:134-141.

3. Patel S. Medicare spending on anti-vascular endothelial growth factor medications. Ophthalmol Retina 2018;2:8:785-791.