How we document notices of noncoverage (other than telling patients verbally, “Your insurance doesn’t cover it.”) can be crucial when the payer is Medicare Part B. For other payers—including Medicare Part C, or Medicare Advantage—the principles are the same. It’s often preferable, and sometimes mandatory, for us to issue one of these waivers as a way to document the conversation and obtain a signature. For Part B Medicare, the ABN is the proper form.

The Centers for Medicare & Medicaid (CMS) notes the following: “The Advance Beneficiary Notice of Noncoverage (ABN), Form CMS-R-131, is issued by providers … physicians, practitioners, and suppliers to Original Medicare … beneficiaries in situations where Medicare payment is expected to be denied. The ABN is issued in order to transfer potential financial liability to the Medicare beneficiary in certain instances.” Guidelines for issuing an ABN properly are published by

Q When is an ABN required?

A When coverage for the service is uncertain (such that you can’t determine in advance whether or not the beneficiary may be responsible for payment), issuance of the ABN is required. Some of the more common situations for this are when a test would potentially be covered but it’s done in advance of an order for it (defined in that case as a screening), when an eligible diagnosis isn’t present, and for durable medical equipment (DME) noncovered items purchased at the same time as DME-covered items.

If you’re required to issue one but don’t, without proof of the beneficiary’s advance acceptance of financial responsibility, your office could be required to refund any payment from the beneficiary and can’t pursue him for payment related to these services.

Q When is an ABN prohibited?

A You can’t issue an ABN to circumvent National Correct Coding Initiative edits/bundles. It’s also prohibited to abrogate assignment under your participation agreement with

Q Can I issue an ABN voluntarily?

A Yes. In some cases, such as when the service to be provided to the patient is relatively expensive, issuing an advance beneficiary notice is a good idea in order to be transparent in advance and to help address the patient’s potential to experience “buyer’s remorse” later on. CMS notes: “When the ABN is used as a voluntary notice, the beneficiary doesn’t [need to] choose an option box or sign the notice.”

Q What’s the most current version of the ABN form?

A CMS gives this form the number CMS-R-131; the June 21, 2017 version is the most current one and you can see the “03/2020” version date at the bottom of the correct form. Importantly, older versions of the ABN are considered invalid if used now, so make sure that all old ones get destroyed so that they don’t reappear later in your clinic.

Q Can I modify the three ABN choices the patient selects from? It doesn’t seem to have “patient-friendly” language.

A While there are some things you can change (adding your name and logo, the particulars of what you are presenting, etc.), changing the three options’ actual language is strictly prohibited. As a reminder, those three options are:

- Option 1. I want the _____ listed above. You may ask to be paid now, but I also want Medicare billed for an official decision on payment … I can appeal to Medicare …

- Option 2. I want the _____ listed above, but do not bill Medicare. You may ask to be paid now as I am responsible for payment. I cannot appeal to Medicare …

- Option 3. I don’t want the _____ listed above. I understand with this choice I am not responsible for payment … I cannot appeal to Medicare …

If the beneficiary chooses Option 1, you must file a claim and append an appropriate modifier to the reported item(s) or service(s). Option 2 applies to situations where Medicare is precluded from paying for the item or service and the beneficiary does not dispute the point; you aren’t required to file a claim. If the beneficiary chooses Option 3, there is no claim to file or charge to make; the service isn’t provided because he said he doesn’t want it.

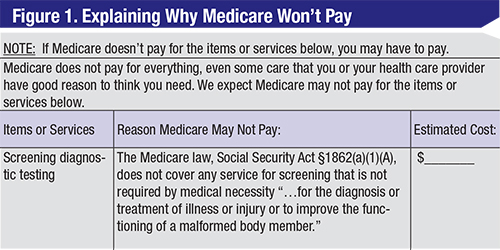

Q How much information do I have to put into the boxes to explain why Medicare might not pay on the ABN form?

|

| Click to enlarge. |

Q Are there other requirements for an ABN?

A Yes. In addition to citing the relevant citation as noted above, an ABN must be one-page, single-sided, on white paper and issued in advance of the service contemplated. The patient’s questions must be answered in full before you ask her to sign. You must use blue or black ink, but you may also issue the ABN electronically (In this case, be sure to also offer the beneficiary a paper copy of what she signed.). As the issuer of the ABN, you must maintain a copy in your files (paper or electronic). You can’t “pre-select” one of the three options for the beneficiary. Additionally, you can’t use patients’ old Medicare numbers or their new Medicare Beneficiary Identifier (MBI) numbers from the new cards that are currently being rolled out.

Of note, you can have an attachment page when the information in the required boxes might prevent a violation of the “one-page, single-sided” rule.

Q What about other payers?

A While patients think that

Mr. Larson is a senior consultant at the Corcoran Consulting Group. Contact him at plarson@corcoranccg.com.