The start of the new year is a perfect time to review updates in place for 2023 and perhaps revisit your compliance efforts to help ensure continued accuracy in your billing procedures. This article highlights important changes for coding, reimbursement and regulations that impact ophthalmic practices.

Q: What’s new in terms of provider reimbursement?

The 2023 Medicare Physician Fee Schedule (MPFS) was published in the Federal Register on November 1, 2022. MACRA provided a neutral (0.0 percent) update to physician payments for 2023. However, when you factor in required budget neutrality adjustments and the expiration of the 3-percent increase to the 2022 PFS payments, the proposed 2023 PFS conversion factor, is $33.06; a decrease of 4.6 percent. Then include the 2 percent sequestration payment adjustment applied to all Medicare Fee-for-Service claims and the PAYGO cuts. The result is a 10.6-percent cut to Medicare rates in 2023.

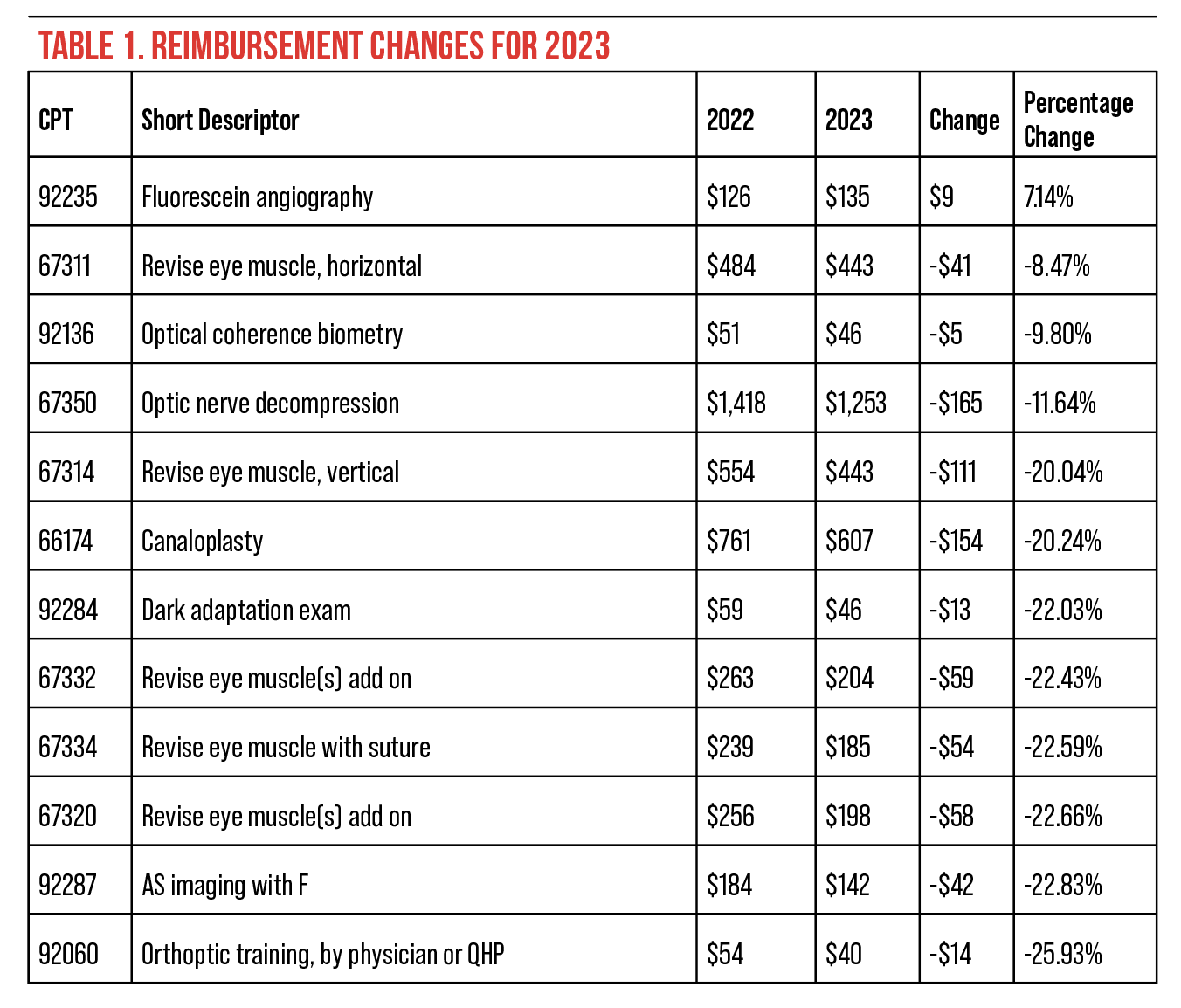

Due to changes in RVUs for certain services, not all codes are impacted equally. Below, we’ll look at a few of the more notable changes (percentage change amounts appear in Table 1).

|

Q: What’s new for facility reimbursements?

ASCs that met their quality reporting requirements received a 3.8-percent increase to the conversion factor, now $15.813.2

Those that failed to meet their quality requirements in the most recent reporting year saw only a 1.8-percent increase.

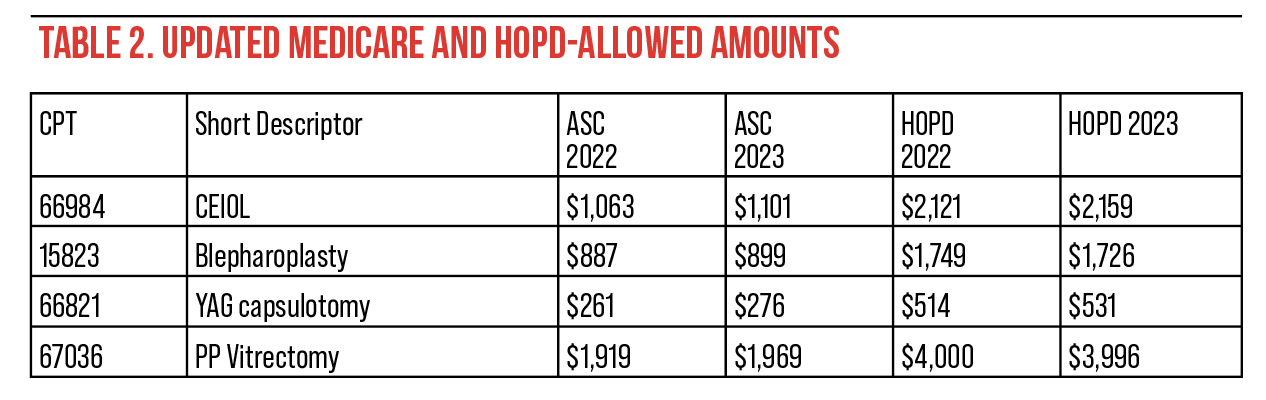

Payment rates for hospital out-patient departments (HOPDs) also went up 3.8 percent. Table 2 lists the 2022 and 2023 Medicare ASC and HOPD allowed amounts for a few common ophthalmic procedures.

The CPT codes for procedures with an artificial iris (0616T, 0617T and 0618T) have all been assigned to a single APC (APC5495) due to the offset percentage for the prosthetic device. When the device offset percentage exceeds 30 percent, CMS assigns higher rates to the ASC.3

For 2023, Quality measures ASC-1 through ASC-4 are required, and providers are now required to submit quality-measures data, rather than claims, through the HQR System (formerly known as the QualityNet Secure Portal). Because reporting will no longer be claims-based, measures are required on all patients, not just Medicare ones.4

|

Q: What are the latest rules for reimbursement for injectables in an ASC?

ASCs will continue to receive separate reimbursement for Omidria (J1097) under Medicare regulations.

The pass-through status for Dextenza (J1096) and Dexycu (J1095) expired on 12/31/22. Under Medicare regulations for non-opioid pain management drugs and supplies, Dextenza will continue to be reimbursed separately in the ASC. It won’t be paid separately in an HOPD.

Insertion of the Dextenza implant is identified with code 68841 (Insertion of drug-eluting implant, including punctal dilation, when performed, into lacrimal caliculus each) which was reassigned to APC5503. The ASC won’t receive reimbursement for 66841 when it’s performed with concurrent procedures. The ASC may be paid for the insertion when it’s done as a standalone procedure.

ASCs will no longer be paid separately for Dexycu (J1095), since it doesn’t qualify as a non-opioid pain management drug.

Q: What changes have been made to CPT codes?

Coding for evaluation and management (E/M) services again took center stage in 2023 as the AMA revised the inpatient E/M codes to correlate with the guidelines for office and outpatient coding. No longer will the elements of the documented patient history or physician exam impact the level of service. Select the level of service for these E/M codes based solely on the medical decision making or the physician time dedicated to the encounter. The changes apply to hospitals, nursing homes and a patients’ residences, as detailed below.

In a hospital setting, the following codes were revised:

• initial hospital inpatient or observation care (CPT codes 99221 – 99223) (note the codes for initial observation care [note that CPT codes 99224 -99226] have been deleted);

• subsequent hospital inpatient or observation care (CPT codes 99221 – 99233) (note CPT codes 99218 – 99220 have been deleted);

• hospital inpatient or observation care services (including admission and discharge, CPT codes 99234 – 99236);

• hospital inpatient discharge services (CPT codes 99238 and 99239) (note CPT 99217 has been deleted); and

• emergency department services (CPT codes 99281 – 99285).

In terms of CPT coding, the “nursing facility” includes skilled nursing facilities, psychiatric residential treatment centers and immediate care facilities.

In those settings, the following codes were revised:

• initial nursing facility care (CPT 99304 – 99306);

• subsequent nursing facility care (CPT 99307 – 99310) (note that code 99218 has been deleted this year);

• nursing facility discharge services (CPT 99315 and 99316);

• domiciliary, rest home or custodial care services, new patient (CPT 99341 – 99345) (note that codes 99324 – 99324 have been deleted); and

• domiciliary, rest home or custodial care services, established patient (CPT 99347 – 99350) (note that codes 99334 – 99347 have been deleted).

The 2021 Evaluation and Management guidelines now apply to both outpatient (CPT 99241 – 99245) and inpatient (CPT 99251 – 99255) consultations. Medicare hasn’t reimbursed for consultations for several years, but some other payers do.

Q: What are the changes to prolonged-service codes?

When coding is based on physician time spent, remember that extraordinarily long encounters that exceed the physician requirements for the assigned E/M code can be reported with an additional code. AMA provides code 99417 for prolonged encounters with the patient and code 99349 for prolonged services without a same day patient encounter. Report the prolonged service once for each 15-minute increment.

For Medicare claims, there are three same-day prolonged-service codes, each based on the place of service:

• G0316–Prolonged E/M, hospital inpatient, each additional 15 min;

• G0317–Prolonged E/M, nursing facility, each additional 15 min; and

• G0318–Prolonged E/M, home or residence, each additional 15 min.

Selecting the specific code level based on medical decision making or physician time dedicated to each of these codes is beyond the scope of this article. Physicians and coders are encouraged to review the updated information in the 2023 CPT manual.

Other than these E/M code updates, CPT has only a few new codes, revisions and deletions applicable to ophthalmology. The affected codes are listed below. For the revised codes, the text shown here as underlined is new to the code definition.

Revised codes:

• 66174–Transluminal dilation of aqueous outflow canal (e.g., canaloplasty); without retention of device or stent (Do not report 66174 in conjunction with 65820)

—66175–with retention of device or stent

• 92065–Orthoptic training; performed by a physician or QHP

(don’t report 92065 in conjunction with 92066, 0687T, 0688T, when performed on the same day);

• 92229–Imaging of retina for detection or monitoring of disease, point of care autonomous analysis and report; unilateral or bilateral; and

• 92284–Diagnostic dark adaptation examination with interpretation and report.

These are the new CPT codes for 2023:

• 0730T–Trabeculotomy by laser, including optical coherence tomography guidance

(Effective: July 1, 2022, Sunset January 2028); and

• 92066–Orthoptic training; performed under supervision of a physician or QHP (don’t report 92065 in conjunction with 92066, 0687T, 0688T, when performed on the same day).

Q: What ICD-10 changes should I be aware of?

ICD-10 code changes and updates apply on October 1st each year so the update for 2023 is already in effect. There were 1,492 new, revised or deleted codes, but none that impact ophthalmology. There are instructions clarifying how to code the use of insulin when used with a non-insulin medication or when used on a temporary basis. They are as follows:

• for oral hypoglycemics + insulin, report Z79.84 and Z79.4;

• for insulin and an injectable non-insulin antidiabetic medication, report Z79.4 and Z79.899; and

• don’t report Z79.4 or the temporary use of insulin.

Q: I’ve heard there are changes to the reporting of discarded drugs. What are the details?

CMS is finalizing regulations for the JW modifier used to report discarded amounts of drugs, and the new JZ modifier for attesting that there were no discarded amounts. Providers are required to report the JW modifier beginning January 1, 2023, and to report the JZ modifier no later than July 1, 2023 in all outpatient settings. The Medicare Administrative Contractors have been instructed to deny claims submitted without the appropriate modifier.

This will have a great impact on retina practices, as claims for intravitreal medications will require either JW or JZ.

Q: What’s the status of the COVID-19 Public Health Emergency and how does it impact our practices?

At this time, the PHE is still in place. CMS implemented the 151-day extension of Medicare telehealth flexibilities, including:

• allowing telehealth services to be provided in any geographic area and in any originating site setting, including the patient’s home;

• allowing certain services to be provided via audio-only telehealth; and

• allowing PTs, OTs, speech-

language pathologists and audiologists to provide telehealth services.

For 2023 providers are instructed to continue billing telehealth claims with the place of service you would have billed for an in-person visit and use modifier -95 to identify telehealth service through 2023 or until the end of the year in which the PHE ends.

When the PHE ends, flexibility regarding where the patient receives Medicare telehealth services, as well as where the services originate, will revert back to match the restrictions in place prior to the COVID-19 public health emergency. When that occurs, Medicare reimbursement for mental health telehealth services will again require an in-person visit within six months of initial assessment and every 12 months following. Also, Medicare reimbursement for telehealth visits furnished by physical therapists, occupational therapists, speech language pathologists and audiologists will no longer be allowed. Medicare will no longer cover audio-only visits for physical health encounters, and FQHCs and RHCs will no longer be able to be reimbursed as distant site telehealth providers for non-mental health services.

Q: Have there been any developments on office-based surgery?

In recent years, there’s been a growing interest in office-based surgery in ophthalmology. Those in favor cite provider convenience, patient experience and contained costs as some of the advantages. On the other hand, opponents have raised concerns regarding such things as sterility, anesthesia provided in an office-based setting, the quality and maintenance of surgical equipment and the ability to detect and address complications.

To make OBS possible for most providers, the finances need to make sense. For refractive or cosmetic procedures, or care provided to uninsured patients, this model may work. For services billed to Medicare, there is very little the physician may bill. Medicare allows $124 for an IOL but doesn’t pay for—or permit providers to bill patients for—a facility fee, surgical supplies, anesthesia by the surgeon or medications that would be eligible for passthrough payment in an ASC. Also, providers may not create an “overhead fee” and bill the patient for it.

In the response comments in the final ASC rule, CMS states: “… we have concerns about these services being furnished in non-facility settings ... CMS will continue to evaluate whether these services are being furnished in non-facility settings and will consider establishing non-facility values for these services at that time.”2

Q: What changes will Medicare beneficiaries have to deal with this year?

The 2023 Medicare Part A inpatient deductible is $1,600, up from $1,556 in 2022. The 2023 Part B deductible is $226, down from $233 in 2022. For most patients, the monthly Part B premium is $164.90, a decrease from the previous value of $170.10. Remember, since 2007, beneficiary premiums are based on individual or household income. Roughly 7 percent of people with Medicare pay a higher premium based on their income. The increased premiums range from $164.90/month for individuals who earn more than $97,000/year to $560.50/month for individuals with an annual income over $500,000.5

Enrollment in Part C Medicare, or Medicare Advantage, continues to increase. In 2022, 28.4 million out of 58.6 million eligible Medicare beneficiaries (48 percent) were enrolled in a Medicare Advantage plan, which is an increase of two percentage points compared to 2021. The Congressional Budget Office estimates that, by 2023, enrollment will rise to about 61 percent of eligible beneficiaries.

In conclusion, each year brings changes to the coding instructions and reimbursement rates that impact all eye-care professionals. Keeping your staff educated on the current codes and instructions is an important aspect of your compliance efforts.

Mary Pat Johnson is a senior consultant at the Corcoran Consulting Group and is based in North Carolina. She can be reached at mpjohnson@corcoranccg.com.

1. Medicare and Medicare Programs. CY 2023 payment polices under the physician see schedule and other changes to part b payment and coverage policies. Federal Register, 11/01/22.

2. Medicare Program: Hospital outpatient prospective payment and ambulatory surgical center payment systems and quality reporting programs. Federal Register, 11/23/2022.

3. CMS, HOPD 2023 NFRM Addendum P.

4. CMS, Final 2023 ASCQR Measure Set.

5. CMS Fact Sheet. https://www.cms.gov/newsroom/fact-sheets/2023-medicare-parts-b-premiums-and-deductibles-2023-medicare-part-d-income-related-monthly.