In late August, Alcon’s CyPASS Microstent was suddenly withdrawn from the market due to significant endothelial cell loss seen in an extension of the study that won the device approval from the U.S. Food and Drug Administration. Since then, more information about what triggered the product withdrawal has become available, and the American Society of Cataract and Refractive Surgery has released guidelines for surgeons whose patients have already been implanted with the device.

|

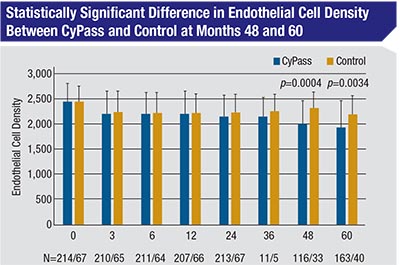

The original COMPASS study compared the safety and efficacy of implanting the CyPASS device at the time of cataract surgery, to cataract surgery alone. Although the study’s two-year follow-up didn’t find a statistically significant difference in endothelial cell loss between the control group and CyPASS group, that changed by the five-year followup in the COMPASS-XT study. At five years, the mean endothelial cell count in the control subjects had dropped from 2,434 at baseline to 2,189, a 10-percent drop; but in the CyPASS patients, the ECC dropped from 2,432 at baseline to 1,931—a 21-percent drop. (Fortunately, despite the losses of endothelial cells, all corneas remained clear and no eyes required corneal surgery at five years.) However, this loss was not found uniformly among the CyPASS patients, leaving researchers to search for an explanation.

As it turned out, anterior chamber pictures from the COMPASS-XT study revealed differences in how deeply the device was implanted, and that correlated with the likelihood of increased endothelial cell loss. The device has three retention rings on its collar; implants that had no rings showing in the anterior chamber following implantation had a mean endothelial cell loss of 1.39 percent per year; implants that had one ring visible had a loss rate of 2.74 percent per year; and those with two or three rings visible had a loss of 6.96 percent per year. (For comparison, eyes in the control group had a mean loss of 0.36 percent per year—a much lower rate than historic norms for healthy eyes following cataract surgery.) However, even this correlation wasn’t perfect: Some eyes with multiple rings visible have had minimal endothelial cell loss.

Given this information, on October 4, ASCRS issued an official statement making the following recommendations for patients who already have an implanted CyPASS:

• Monitor these patients at appropriate intervals, including performing gonioscopy to check the position of the implant. Because eyes with multiple rings visible did not all experience a high rate of endothelial cell loss, no action beyond monitoring is recommended unless you find evidence of corneal decompensation—although increasing the frequency of corneal evaluation could be considered. (Alcon recommends periodic assessments of endothelial cell density using specular microscopy.)

• If more than one ring is visible and corneal decompensation develops, trimming the proximal end of the device appears to be the least risky intervention. (Repositioning or removing the device can be problematic, due to likely fibrosis around, and possibly through, the filtration holes of the device.) Alcon notes that there’s limited clinical data regarding the impact of trimming the device, so when deciding whether or not to proceed, surgeons should consider the possibility of causing further endothelial cell trauma. The ASCRS statement notes that in the absence of clinical sequelae, device adjustment or removal isn’t recommended.

• In terms of notifying patients already implanted with the device, ASCRS recommends checking the policies of your practice, hospital and/or ASC regarding what to do when an implant has been voluntarily withdrawn from the market.

|

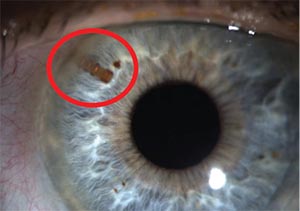

| An image of the CyPASS glaucoma micro- stent following implantation. The device was withdrawn from the market due to issues with long-term endothelial cell loss. |

Atlanta glaucoma specialist Reay Brown, MD, who participated in the COMPASS study, says he was very surprised that there was any problem with the device. “It’s small and stable,” he notes. “I haven’t seen any cornea problems in my patients, and I have patients from the study who are more than seven years out. All of their endothelial cell counts have been fine.”

Dr. Brown is skeptical that Alcon will be able to reintroduce the device with different guidelines in the future. “I thought it was terrible that the CyPASS wasn’t approved for use in pseudophakes,” he says, “After all, we always put the CyPASS into the eye after the cataract surgery has been completed, so we’re already putting it in pseudophakic eyes. But it was made clear to me that the FDA will only approve devices based on studies. So without further studies, I’d be surprised to see any new approval—especially now that the endothelial cell loss issue has been discovered.”

2CTech: A Case Study in a Retina Start-Up

In Ocular Product Development Insights, we’ve discussed broad product-development topics that are especially relevant to physician entrepreneurs who are at the early stage of an investment opportunity and/ or starting up a business. In prior columns, we’ve covered case studies and discussed issues like the proper selection of a drug’s indications, the pathway to proof-of with the ultimate objective of improving light sensitivity and visual function.

The QD particles can be introduced into the vitreous via a routine intravitreal injection, at which point they diffuse through the retina. The particle emissions result in direct stimulation of the neural retina, and also elicit the release of growth factors that could amplify or extend the duration of effect. The intended encode proteins for phototransduction. Generally, many of these therapeutic approaches target specific variants. 2CTech is taking the approach that the QDs may stimulate photoreceptors regardless of which genetic variant caused the disease, and potentially could also be used in conjunction with future gene therapies, other neurostimulation devices or other retinal treatment modalities. In concept studies, ex-U.S. regional deals, financing, intellectual property and strategic relationships. This month we provide an overview of a company that originated from a physician scientist. The company’s subsequent development incorporates key examples and lessons from many of the prior articles.

The company is called 2Ctech (Irvine, California), and its initial concept came out of individual work by Jeff Olson, MD, a retinal specialist at the University of Colorado, as well as from a collaboration with his department chair, Naresh Mandava, MD. Dr. Olson wanted to see if it would be possible to take a retinal implant that provides electrical stimulation to the cells and “grind it up” into millions of small stimulation devices that are spread throughout the retinal layers. He subsequently learned that materials of the type he imagined already exist in the nanotechnology world, and are called Quantum Dots (QDs).

QDs are biocompatible crystalline nanoparticles a few nanometers wide, engineered to be sensitive to energy of different wavelengths. QDs behave like mini solar cells, producing energy in response to light. When excited by light, electrons inside the QD are boosted to a higher level and, when they return to a lower level, the QDs emit energy in the form of photons. Each QD contains a crystalline core that’s encapsulated in an inert shell and surrounded by a hydrophilic coating that enables the material to be supplied as a colloidal solution of semiconductor nanocrystals. This combination of coatings is used to protect the core/shell from oxidative damage, enhance the efficacy of the particle, allow the particle to be suspended in water and to sequester the heavy-metal core from the environment. 2CTech has been developing QD technology with the intention of delivering photovoltaic stimulation to the retina in patients with retinal degenerative diseases, result would be a periodically administered treatment that could preserve or enhance vision in patients with degenerative diseases.

Selecting an Indication

The manner in which the product can induce electrical stimulation of photoreceptors has implications across multiple retinal diseases, ranging from inherited retinal diseases (IRD) such as retinitis pigmentosa and Stargardt’s, to diabetic retinopathy, dry age-related macular degeneration and even glaucoma (via neuroprotection). While the largest market is arguably dry AMD, multiple factors led 2CTech to choose RP as the lead indication. As an orphan indication, the studies are smaller in size and there are clear, accepted, validated endpoints available for IRD, thanks to the approval of Luxturna (Spark) for RPE-65-mediated LCA-2. The intention is that RP serves as proof-of-concept for retinal degeneration as a whole.

There are multiple drug development programs in the pipeline that focus on IRD, many with potentially exciting gene-therapy and nucleic-acid-based approaches that target specific genetic variants of the IRDs. RP as a broad classification is an orphan condition, and consists of many genetic variants—more than 80 genes associated with RP and LCA encode proteins for phototransduction. Generally, many of these therapeutic approaches target specific variants. 2CTech is taking the approach that the QDs may stimulate photoreceptors regardless of which genetic variant caused the disease, and potentially could also be used in conjunction with future gene therapies, other neurostimulation devices or other retinal treatment modalities. In addition, other work with electrical stimulation of the neuroretina (such as Second Sight’s Argus II) has shown that electric stimulation generated by implants can also generate visual improvements, and this serves as an additional “reason to believe” in the general concept. Investors and industry also view programs in IRDs as indications that can drive investment in their companies, as well as transactions with other pharma and bio-tech entities (see Allergan/Editas, and Novartis/Spark). Therefore, a therapeutic technology with an effectiveness that can span genetic variants would certainly be supported by the commercial model that many other companies are pursuing for individual variants.

Financing

The initial work of 2CTech was financed by a convertible loan from the University of Colorado, plus two grants from the state of Colorado. An investment (both equity investment and an additional convertible note) from a strategic partner (Hoya, Japan) further comprised the Series A financing. Hoya was motivated by the prospect of nanotechnology applied to retinal disease, with a goal of making an initial financial investment in a project that had a clear path to the next steps. Such an investment gains the partner early visibility in an area of strategic interest. The investment by this company was made without reserving any specific rights to the product. (Note that in some situations where a strategic partner has exclusive access, potential future investors may see such a deal as having a potential cap on its upside for them, and thus would want to see appropriately structured terms for that access.) This Series A helped 2Ctech accomplish key items of preclinical work, and an early human feasibility clinical trial.

A preclinical study was conducted in a relevant rat model, and demonstrated safety, efficacy and pharmacokinetics. The studies showed a clear benefit associated with the semiconductor particles and no evident negative effect on photoreceptor cells. In addition, a rabbit study was conducted, demonstrating clearance of quantum dots in the vitreous through the retina. Manufacturing capability was also secured with this early funding round.

With the initial funding, 2CTech then light levels. In order to best demonstrate improvement following quantum-dot therapy, at baseline the subject population should be unable to navigate a particular course at low light levels in order to support the objective of demonstrating an improvement in mesopic navigation following treatment. Therefore, courses at various difficulties are desired. Ora has developed and operates four separate mobility courses consisting of up to 21 different course/light level combinations for patients with inherited retinal diseases performed an early, small, clinical pilot study outside the United States. Several more goals remained at this stage, namely: formally meeting with the FDA in order to define the pathway; defining the ideal patient population and inclusion/exclusion criteria for the planned clinical trial; and securing access to the dots.

The first tranche of the Series B (B-1) was then brought together with additional investment from Hoya of $4 million. This funding enabled 2CTech to achieve key milestones that checked off several items that would be required for additional funding (a planned B-2 round): generating valuable pre-treatment clinical data; securing a supply of materials; confirming a clinical-regulatory pathway with the FDA; and engaging advisors and key opinion leaders. 2CTech was able to secure an applicationspecific and exclusive license-and-supply agreement for quantum dots—representing an IP enhancement—and the funding of Series B-1 enabled the purchase of a quantity of quantum dots sufficient for the upcoming trial(s). Work was completed to define the regulatory pathway with the FDA, and thanks to this round of financing the company was able to conduct a clinical trial (pre-treatment).

Clinical Program & Endpoint Selection

After the FDA’s review of the protocol and study plan, the pre-treatment clinical trial was conducted at Baylor University in collaboration with our retina group at our development firm, Ora (Andover, Massachusetts). This pretreatment feasibility study assessed the impact of different acuities and visual fields of RP subjects on their ability to navigate specific navigation courses, because potential improvements in vision after therapy may be characterized by improvements in the ability to navigate different mobility courses at low ambient to assess differing levels of visual function (called the Visual Navigation Course or VNC). By running this study early, 2CTech identified which patients should enter into the eventual treatment trial, established patient baseline performances on the test, and confirmed that the test protocol can determine a range of potential improvement in visual function generated by the treatment.

A unique feature of Ora’s mobility courses is their modular nature, which specifically facilitates multicenter studies. Identical mobility courses can be installed and validated at any clinical site and, as a result, 2CTech’s followon study can leverage the same general protocol methods and identical courses to those tested in the feasibility trial, increasing the likelihood of replicating results.

Once the second tranche of the Series B is funded, 2CTech will be primed with quantum-dot supplies, a protocol, an accepted endpoint and a patient population, which will allow it to proceed rapidly into the controlledtreatment proof-of-concept study.

In conclusion, the case example of 2Ctech demonstrates a program initiated by a physician-scientist that created a reason-to-believe with early funding, identified key issues that future investors would want to see resolved, and subsequently resolved many of these issues in order to de-risk the program. The case of 2Ctech is also an example of the value of a pre-treatment study for identifying the population and criteria once full funding is in place for the treatment evaluation. With a relatively small amount of early funding, 2Ctech is now poised to validate a novel technology for retinal degenerative conditions. REVIEW

Mr. Chapin is senior vice president of corporate development at the research and development firm Ora Inc. He welcomes your comments or questions regarding product development. Send correspondence to mchapin@oraclinical.com or visit oraclinical.com.