|

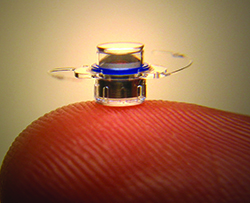

The IMT is a lens system 3.6 mm wide and 4.4 mm long that’s implanted in the capsular bag through a large incision. Once inside the eye, it uses wide-angle micro-optics that, when combined with the cornea’s optics, create a telephoto system that magnifies objects in front of the eye by approximately 2.2 to 2.7 times. In the end-stage AMD patient with a central macular blind spot, this magnification takes central images and projects them onto healthy areas of the retina. In a long-term study of the device, 103 (59.5 percent) of 173 telescope-implanted eyes gained three or more lines of best-corrected vision, compared to 18 (10.3 percent) of 174 fellow control eyes.1 In the Food and Drug Administration trial of the IMT, the mean best-corrected distance vision went from 20/312 to 20/171 at four years.

“Decreasing the minimum age to 65 will expand the number of patients eligible for the treatment,” says Los Angeles retinal specialist David Boyer, who evaluates patients for possible IMT implantation. “We have a paper due to come out that shows younger patients do better than even the older patients. This would allow patients with visual loss secondary to AMD to avail themselves of this treatment earlier.”

Memphis, Tenn., retinal specialist Steve Charles, also a clinical professor at the University of Tennessee, says that though the IMT gives some visual improvement to patients, it has limitations. “First and foremost, it gives a very modest visual improvement,” Dr. Charles says. “We’re not dealing with a patient who is 20/400 becoming able to read small print. Also, because of the reduced field of view, a patient can’t drive with this. It also results in marked aniseikonia—the image size is different between the two eyes—which poses a falling risk. In addition, today we have very viable, successful treatments for AMD such as Eylea and Lucentis, which may mean patients’ vision doesn’t reach the point where they’re eligible for the IMT. Finally, implantation requires a very large incision at a time when the cataract community is striving for smaller ones.”

Dr. Boyer acknowledges that patients have to be properly screened to be able to handle the new vision from the IMT. “Not everyone with geographic atrophy or end-stage wet AMD is eligible for it,” he says. “A lot of patients can’t tolerate it and feel off-balance. It requires some training, and part of [VisionCare’s] CentraSight program is to ensure that patients are well-screened so that patients who will benefit the most will have it. These aren’t driving patients. There are some patients with external telescopes that do drive, because they have a bioptic or something that enables them to do that. I wouldn’t put the IMT in those driving patients because they’d probably lose the ability to drive, and would need the peripheral vision in the other eye and different clues to be able to drive.

“It’s true that we’re able to reduce vision loss tremendously [with anti-VEGF treatments],” Dr. Boyer continues. “But, if you follow these patients longer, even some on treatment will lose vision if they develop dry AMD changes.”

VisionCare has initiated a patient education and support program about end-stage AMD and the IMT called CentraSight. Through the program, patients can see if they meet eligibility criteria and experience a simulation of what vision would be like with the IMT. Dr. Boyer notes that, again, not everyone will qualify. “I think a patient who is doing well with his low-vision aids would probably not be a candidate, or someone for whom I’d recommend this treatment,” he says. “However, there are patients who say, ‘I get some improvement with a telescope mounted externally,’ and, if they qualified in every other way, they might be happy, because the vision quality that results from putting the lens inside the eye may be much greater for them.”

1. Hudson HL, Stulting RD, Heier JS, Lane SS, et al, IMT002 Study Group. Implantable telescope for end-stage age-related macular degeneration: Long-term visual acuity and safety outcomes. Am J Ophthalmol 2008;146:5:664-673.

Allergan/Actavis Turn Sights to the Task of Merging

Following months of fending off a hostile takeover, Allergan is moving forward as part of Dublin, Ireland-based Actavis; the combined company is now ranked as one of the top 10 global pharmaceutical companies by sales revenue.

| ||||||||

Formerly the CEO of Bausch + Lomb, Mr. Saunders knows ophthalmology well and recognizes the profession’s unique relationship with industry. “You really have an engaged physician audience,” he said. “Ophthalmologists appreciate innovation; they like to understand the science and technology behind innovation. They’re very open to advancing eye health and looking for ways to solve unmet medical needs in partnership with industry. That’s a really nice collaboration to have with your physicians.”

Of the struggle to keep control of the company throughout most of 2014, Allergan CEO David Pyott said, “If there is an irony in all of this, it’s that we will have the best sales-growth year in our 64-year history. Year-to-date, sales have grown 16 percent across the board. Within ophthalmology, we have been the fastest-growing fully integrated ophthalmic company globally, with IMS showing about 14 percent growth in ophthalmics.”

“Fortunately, Brent and I have known each other for a while,” said Mr. Pyott. “He had indicated his interest at a very high level a couple of months ago. And that led to conversations. We came together because we realized the two companies have a lot of common goals. We believe in innovation. Actavis this year, as a company on its own, is spending about $1.3 billion on R&D. To their credit, they have been successful. They have no fewer than seven new drug applications at the FDA. That’s a testament to the fact that not only do they spend, but they’re very successful. We too have been successful. I think we’re now up to 14 products approved by the FDA since 2010.”

The two leaders see the ophthalmology component of Allergan surviving intact. “In terms of the future operations, because there is really no overlap in ophthalmology per se, Actavis will leave a successful team in place” at Allergan, said Mr. Pyott.

Bloomberg News reported in late December that much of the leadership at Allergan will be assumed by Actavis executives. Mr. Pyott was expected to be offered a position on the board. What will remain is the Allergan brand.

“The Allergan brand remains,” said Mr. Saunders. “We have to figure out the right context, in terms of the Actavis brand as well. The Allergan brand will exist.”

Supplements Are Found Wanting in Formulas, Claims

|

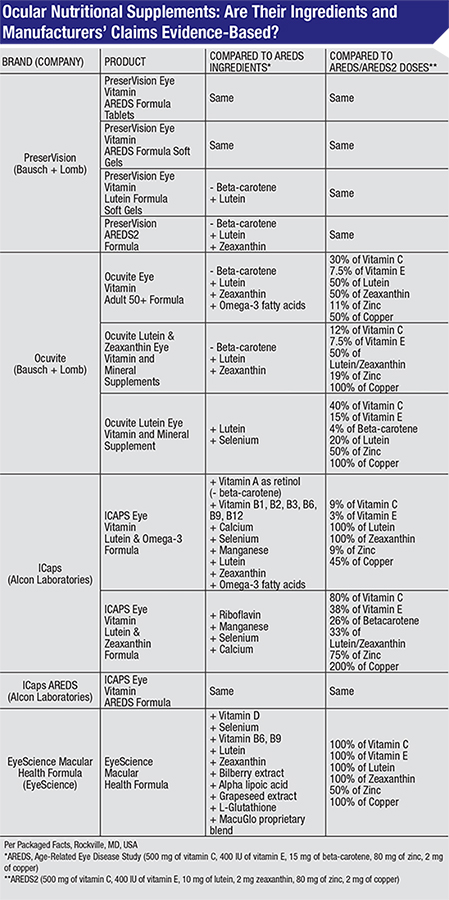

Recommended treatment for age-related macular degeneration at certain stages of the disease includes nutritional supplements. The landmark Age-Related Eye Disease Study found in 2001 that a specific formula of nutritional supplements containing high doses of antioxidants and zinc could slow the worsening of AMD in those who have intermediate AMD and those with advanced AMD in only one eye. A follow-up study that concluded in 2011, AREDS2, determined that the formula was still effective if one ingredient, beta-carotene (a form of vitamin A), was replaced with related nutrients, lutein and zeaxanthin. Beta-carotene was substituted in AREDS2 due to its link to increased risk of lung cancer in smokers. The two studies prompted a surge in sales of eye supplements, which are marketed as containing the AREDS or AREDS2 formulas.

To test whether the products are consistent with the studies’ findings, researchers compared the ingredients in top-selling brands to the exact formulas proven effective by AREDS and AREDS2. The researchers, based at Yale-New Haven Hospital-Waterbury Hospital, Penn State College of Medicine, Providence VA Medical Center and Warren Alpert Medical School of Brown University, identified the five top-selling brands based on market research collected from June 2011 to June 2012, and analyzed the brands’ 11 products.

They found that, while all of the products studied contained the ingredients from the AREDS or AREDS2 formulas:

• Only four of the products had equivalent doses of AREDS or AREDS2 ingredients;

• Another four of the products contained lower doses of all the AREDS or AREDS2 ingredients;

• Four of the products also included additional vitamins, minerals and herbal extracts that are not part of the AREDS or AREDS2 formulas.

In addition, while all 11 of the products’ promotional materials contained claims that the supplements “support,” “protect,” “help” or “promote” vision and eye health, none had statements specifying that nutritional supplements have only been proven effective in people with specific stages of AMD. There were also no statements clarifying that currently there is not sufficient evidence to support the routine use of nutritional supplements for primary prevention of eye diseases such as AMD and cataracts.

“With so many vitamins out there claiming to support eye health, it’s very easy for patients to be misled into buying supplements that may not bring about the desired results,” said first author Jennifer J. Yong, MD. “Our findings underscore the importance of ophthalmologists educating patients that they should only take the proven combination of nutrients and doses for AMD according to guidelines established by AREDS and AREDS2. It’s also crucial that physicians remind patients that, at this time, vitamins have yet to be proven clinically effective in preventing the onset of eye diseases such as cataracts and AMD.”

A results table of the analyzed products can be found at http://www.aao.org/newsroom/release/upload/Table-1-OcularNutritionalSupplements-InPress.pdf.

The AAO recommends ophthalmologists consider antioxidant vitamin and mineral supplementation, per the AREDS and AREDS2 trials, for patients with intermediate or advanced AMD. It also maintains that, based on the six-year timeframe of the AREDS trial, there is no evidence to support the use of these supplements for patients who have less than intermediate AMD. Ophthalmologists can read the Academy’s AMD Preferred Practice Pattern guidelines at http://bit.ly/aaoamdppp. The public can learn more information about AMD and AREDS supplements at http://bit.ly/eyesmartamd. REVIEW