Not long ago, patients diagnosed with neovascular age-related macular degeneration were limited to vitamin and mineral supplements, photodynamic therapy or laser photocoagulation. The advent of anti-vascular endothelial growth factor treatments has given many patients new hope. This hope comes at a cost, however: an often-lifelong treatment burden. Here, experts discuss what’s in the pipeline with regard to antiVEGFs, as well as some novel potential nAMD therapies.

Repackaging Anti-VEGF A

Michael W. Stewart, MD, professor and chair of ophthalmology at the Mayo Clinic Florida in Jacksonville, thinks it’s important for surgeons to prioritize durability for the foreseeable future. “Since anti-VEGFs are the only thing we have right now, the duration of action is a big deal,” he says. “Usually at the beginning, I tell my patients that this is a treatment, not a cure, and we’re going to start off monthly and then we can determine the frequency, depending on how well they react to the drug. I try to set them up to expect that this is a long-term proposition, and we’re going to see each other at some interval essentially forever.”

Pravin U. Dugel, MD, managing partner at Retinal Consultants of Arizona and clinical professor at the Roski Eye Institute at the University of Southern California’s Keck School of Medicine, says that the current treat-and-extend paradigm would be greatly aided by therapies that would reliably do any or all of the following: improve vision immediately; create lasting visual improvement over the long term; or have longer duration of action. “These are extremely variable diseases and some patients require very intense treatment. I have a few patients—thank goodness, only a few—who need treatment every two weeks. There are other patients who can be extended to every four months. The bottom line is that the labeling is not going to determine how we use a drug. But if we find a better antiVEGF, I think there’s definitely room for that, and we will definitely adopt it,” he says.

“We basically have three drugs,” he continues. “There’s Avastin, which is compounded and not FDA-approved. We’ve got Lucentis, which is the one that we have the most experience with, and we have Eylea. All three have their plusses and minuses.”

Two of the current anti-VEGF A’s, Lucentis (Genetech; San Francisco) and Eylea (Regeneron; Tarrytown, New York), are striving for enhanced therapeutic value through a new delivery system and relabeling, respectively.

|

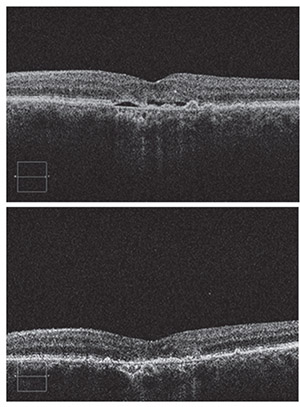

| Top: Baseline SD-OCT image showing subretinal fluid and drusen due to choroidal neovascularization. Bottom: Four weeks after a single intravitreal bevacizumab injection, the subretinal fluid has completely resolved. Successful cases such as this set the bar high for future therapies. All images by Michael W. Stewart, MD. |

Genentech says that its Ranibizumab Port Delivery System (RPDS) may ease the burden to patients, caregivers and health-care systems imposed by the current monthly intravitreal injection schedule for Lucentis. The RPDS is a refillable nanoparticle reservoir approximately the size of a grain of rice. The company says that implantation of the RPDS beneath the conjunctiva away from the visual axis takes less than 30 minutes. To refill the reservoir, a proprietary refill needle refreshes the ranibizumab by putting in a new supply of drug while also draining any residual drug from the last fill.

Genentech says the RPDS is currently in Phase II studies (ClinicalTrials.gov Identifier: NCT02510794) to determine how long patients can go between refills. Results are tentatively expected before the end of the year. (At press time, initial results were to be presented at the ASRS meeting.)

First approved by the Food and Drug Administration in 2011 at a recommended dose of 2 mg intravitreally every eight weeks after three monthly loading doses, Eylea (aflibercept) was studied in the Phase III VIEW 1 and VIEW 2 trials,1 in which patients were randomized into the following doses: 0.5 mg/month; 2 mg/month; 2 mg/two months of aflibercept (after monthly loading doses), or 0.5 mg/month of ranibizumab. All of the aflibercept groups were found to be noninferior (as measured by the proportion of patients losing 15 or fewer ETDRS letters at week 52) and clinically equivalent to the ranibizumab control. Based on re-evaluation of this data and subsequent research demonstrating the efficacy of treat-and-extend with Eylea in the ALTAIR study,2 Regeneron submitted a supplemental biologics license application to the FDA for 12-week Eylea dosing. The decision date is August 11, 2018.

Peter Kaiser, MD, a retina specialist in the Department of Ophthalmology at the Cleveland Clinic’s Cole Eye Institute, says, “Even though a fixed 12-week dosing arm was not included in either study, both the VIEW and ALTAIR studies offer strong and consistent clinical evidence that many patients with wet age-related macular degeneration treated with Eylea can maintain their vision gains with a 12-week dosing interval. If FDA-approved, the ability to administer Eylea every 12 weeks for wet AMD treatment would be welcome news for both ophthalmologists and patients.”

Next-Gen Anti-VEGF A

New anti-VEGF A drugs may be coming down the pipeline that could have longer duration of action and/or better binding capabilities.

• Brolucizumab. Novartis (Basel, Switzerland) is preparing to bring brolucizumab (previously known as RTH258 and ESBA 1008), a humanized single-chain antibody fragment that inhibits VEGF A, to market. “Among the new anti-VEGF A drugs, brolucizumab is furthest along,” says Dr. Dugel, who presented the results of Novartis’ Phase III HAWK and HARRIER studies at the 2017 American Academy of Ophthalmology meeting.

HAWK and HARRIER were headto-head, multicenter studies comparing 2 mg of aflibercept with 3 mg or 6 mg of intravitreal brolucizumab. All patients had three monthly loading doses, and were then assessed for disease activity at various pre-specified timepoints starting at week 16. If patients receiving brolucizumab were assessed by a masked investigator as having no disease activity, they were extended to q12-week dosing. The aflibercept group was dosed at q8weeks after the three loading doses per label.

Based on this disease-activity assessment, 57 percent of HAWK patients and 52 percent of HARRIER patients on brolucizumab 6 mg were extended to q12-week dosing up to week 48.3

All brolucizumab groups in both HAWK and HARRIER achieved the primary endpoint of non-inferiority in mean change in BCVA at week 48 compared to aflibercept.

|

| Intravitreal injection performed without an eyelid speculum. Increased duration of action is the goal of many emerging therapies. |

Dr. Dugel says the week 16 data is particularly important because it represents the end of a matched phase in which both drugs were given in an identical regimen. This timepoint represents the purest comparison between these two drugs, he says. In both HAWK and HARRIER, the 6-mg and 3-mg brolucizumab arms had less intraretinal and/or subretinal fluid, less sub-RPE fluid and greater reductions in central subfield thickness than the aflibercept groups at week 16.4 Also, there was less disease activity in both doses of brolucizumab compared to aflibercept. The superior OCT results and superior disease activity assessment results were statistically significant in favor of 6-mg brolucizumab. Aflibercept and brolucizumab had comparable safety profiles.

A secondary analysis of the data, presented at ARVO, showed that the brolucizumab patients who were extended in the first 12-week cycle after the loading doses had an 87-percent (HAWK) and 82-percent (HARRIER) predictability of maintaining that treatment cycle through week 48.5

“The advantage of brolucizumab is that the majority of patients will be able to be sustained on q12-week dosing after the initial loading dose. But in my mind the bigger advantage is that if you look at the head-to-head comparison at week 16 in both HAWK and HARRIER, brolucizumab was superior to aflibercept in all the anatomical parameters,” says Dr. Dugel.

Dr. Stewart, however, emphasizes that q12w dosing of brolucizumab may not pan out for many neovascular AMD patients. “Although the drug did well in Phase III, it was disappointing that it didn’t last predictably for three months,” he says. “That was comparing it with aflibercept q8-weeks as the control. What the developers have elected to do is go to the FDA and ask for q8-week approval, but not q12-week, which is no surprise.”

• Abicipar pegol. Abicipar (Allergan; Dublin, Ireland) is a novel antiVEGF A known as a DARPin (designed ankyrin repeat protein). It’s genetically modified to specifically target the proteins that induce angiogenesis. The manufacturer aims to create a drug with equivalent or superior efficacy to the anti-VEGFs currently available, so patients can undergo less-frequent intravitreal injections.

“Abicipar is a VEGF A inhibitor very much like all the other drugs we have. It works by binding in an almost irreversible manner to soluble VEGF A,” Dr. Stewart explains. “DARPins are a platform of drugs from which— with the right biochemical alterations—you could create a drug that will bind almost anything. DARPins are also being looked at for oncology, but they’re not as far advanced as they are for ophthalmology. The DARPin is a small molecule bound to a pegolated moiety that is supposed to increase its duration of action. The developers are hoping that it will stay in the eye long enough to meaningfully extend the duration of action of anti-VEGF therapy. Some of that’s based on a very small cohort in a Phase I diabetes trial, where they found an average half-life in the eye of about 13.4 days—which, if true, would really speak well for the extended duration of action. But it was only four patients, so it’s pretty hard to know how accurate that was.”

A pair of Phase III studies, CEDAR and SEQUOIA, comparing two dosing schedules of abicipar (q12 weeks and q8 weeks) for safety and efficacy compared to a control group of patients receiving monthly ranibizumab injections, has been completed, and both dosing schedules met the primary endpoint of noninferiority to ranibizumab.

• Conbercept. Conbercept (Chengdu Kanghong Biotechnologies; Chengdu, Sichuan, China) is a novel anti-VEGF A that may be headed for the U.S. market. “Conbercept is a fusion protein like Eylea, except for the presence of domain 4 of VEGF receptor 2, which may give it greater binding ability and a lower isoelectric point. The hope is that it might be a better next-generation anti-VEGF A. It’s already been approved in China, where it’s currently being used for neovascular macular degeneration, as well as pathologic myopia,” says Dr. Dugel.

“Conbercept has many of the same features as aflibercept,” concurs Dr. Stewart. “It’s approved for AMD in China, and they’re just looking to start Phase III trials in the United States right now. We’ll see what happens in the trials, but my guess is that it will prove very comparable to aflibercept.”

A small study of 100 patients treated 1:1 with either 0.5 mg of ranibizumab or 0.5 mg of conbercept intravitreal injections per a treat-and-extend protocol found that both drugs produced equivalent visual gains and anatomic improvements at one year, but that the conbercept group had longer treatment intervals.6

Combination Therapies

nAMD combination therapies may be dual-action or co-formulations. “Angiogenesis is an extremely complicated biological process. If you look at the treatment of angiogenesis in oncology, just one drug against one target is simply not the strategy,” notes Dr. Dugel. “It’s a very complex process where many drugs are used against many targets. There are a lot of parallels to oncology and, therefore, a lot of interest in combination therapy.”

• RG7716. Genentech’s RG7716 (RO687461) is a novel, bispecific monoclonal antibody that binds to both VEGF A and angiopoietin-2. The AVENUE study (ClinicalTrials.gov Identifier: NCT02484690) is a multicenter, randomized, active comparator-controlled 52-week trial to compare change in baseline BCVA at week 40 in 76 patients, randomized into short-interval RG7716 intravitreal injections, long-interval intravitreal RG7716 injections and intravitreal ranibizumab.

“Of the combination agents, I would say the one that is most advanced in development, in the subcategory of angiopoietin inhibitors, is RG7716. This is a bispecific product: One fab arm is anti-ANG-2 and the other is antiVEGF A,” says Dr. Dugel, who presented studies on RG7716 for diabetic macular edema earlier and will present data from the AVENUE and STAIRWAY studies for nAMD treatment at the 2018 Retina Society meeting in September.

• GB-102. Graybug Vision (Redwood City, California) has developed a dual VEGF/PDGF inhibitor called GB-102 (sunitinib malate) for intravitreal injection. Sunitinib, a tyrosine kinase inhibitor, is also used in oncology. Its formulation uses microparticles to minimize systemic effects and help it consolidate to form a biodegradable depot inside the eye. The company says that GB-102 displays neuroprotective properties with regard to retinal ganglion cells as it binds to multiple VEGFRs.

The ADAGIO trial (ClinicalTrials. gov Identifier: NCT03249740) is an ongoing Phase IIb, multicenter, double-masked study comparing two dose levels of GB-102 to aflibercept therapy for nAMD. In it, patients with wet AMD who were already receiving antiVEGF A injections will be randomized into low-dose or high-dose GB-102 arms every six months or a control arm receiving 2 mg of aflibercept every two months. Mean change in BCVA is the primary endpoint.

“This is interesting because it’s a single injection that may last up to six months. It’s in Phase I/II studies, and they haven’t been released yet. We’re awaiting their release,” says Dr. Dugel.

• X-82. Tyrogenex (Rockville, Maryland) recently terminated the Phase II APEX study (ClinicalTrials.gov Identifier: NCT02348359) of X-82 (vorolanib), a dual VEGFR/PDGFR inhibitor, because it had achieved its primary endpoint of visual acuity change at 52 weeks from randomization in nAMD. It’s also being investigated as a cancer treatment. X-82 is unique among nAMD therapies because it’s administered orally.

The APEX study was a randomized, double-masked, placebo-controlled, dose-finding study. Wet AMD patients were treated for a total of 52 weeks with one of three doses of X-82 plus as-needed intravitreal anti-VEGF or intravitreal anti-VEGF plus oral placebo.

Dr. Stewart says that tyrosine kinase inhibitors like X-82 appear promising, but have formidable drawbacks. “The trouble with them is that they have significant side effects,” he notes.

Ashish Sharma, MD, a consultant in retina at Lotus Eye Hospital and Institute in Coimbatore, Tiruppur, India, believes that X-82, if approved, could have value when used with intravitreal anti-VEGF therapy. “It has potential to replace the antioxidants, as per AREDS recommendations,” he says. “It might allow more relaxation of a monthly injection approach.” But like Dr. Stewart, Dr. Sharma notes that systemic side effects may be a challenge. “One-sixth of patients had some adverse events such as diarrhea, nausea and fatigue in Phase I,” he says.

Other Targets

The search for wet AMD therapies with new mechanisms of action agnostic of VEGF A will require patience, according to Dr. Stewart. “I think we’re going to find something that will work, but I’m not sure that we’ll hit on anything very soon,” he says. “For that reason, I think that we’re locked into anti-VEGF therapy, probably as monotherapy, for quite a long time.”

Many experimental treatments in this category are designed to complement intravitreal anti-VEGF A’s. “I think agents that are targeting other molecules are looked at as combination therapies. I don’t think that any of them are truly looked upon as a substitute for VEGF inhibition,” Dr. Stewart says.

• DE-122. Santen (Emeryville, California) is studying DE-122 (carotuximab), a novel intravitreal ophthalmic formulation that is an endoglin antibody. Endoglin is a protein that’s vital to angiogenesis.

DE-122 is being investigated as a therapy that will complement anti-VEGF treatment. It has shown bioactivity in trials, and is currently undergoing a randomized Phase II-a study (ClinicalTrials.gov Identifier: NCT03211234) comparing two different dosing levels of DE-122 combined with Lucentis injections versus Lucentis injections plus sham injections. The primary endpoint is mean change in BCVA at week 24.

• OPT-302. OPT-302 (Opthea; South Yarra, Victoria, Australia) is an anti-VEGF agent, but it inhibits VEGF C and D, rather than VEGF A. “This would be used in combination with anti-VEGF A. The idea is that if you suppress VEGF A there redundant pathways and you may actually increase VEGF C and D, and there are studies in oncology showing that VEGF C in particular, but also D, may be important in resistance or persistence of disease in VEGF A suppression,” Dr. Dugel explains.

A Phase IIb study (ClinicalTrials.gov Identifier: NCT03345082) is currently underway, to see if adding OPT-302 to Lucentis monotherapy improves visual acuity or anatomy compared to Lucentis alone.

“The Phase II-a study was really interesting because in that study, approximately 50 percent of patients had no detectable choroidal neovascular membrane as read by a reading center, which was quite impressive,” says Dr. Dugel.

• ICON-1. Iconic Therapeutics (San Francisco) is in Phase II studies of ICON-1, a tissue-factor inhibitor. Tissue factor is a protein involved in coagulation; when it’s overexpressed, it’s thought to lead to pathologic angiogenesis, cancerous tumors and neovascular eye disease.

The Phase IIb DECO study (ClinicalTrials.gov Identifier: NCT03452527) will compare CNV size at nine months to baseline in newly diagnosed, treatment-naïve eyes that have received intravitreal Icon-1 either in combination with or after intravitreal aflibercept.

Gene Therapy

Gene therapies for nAMD have focused on gene production, as opposed to gene replacement. So far, the results “have been fairly disappointing,” according to Dr. Dugel. He cites the Phase IIb investigation of AVA101 (Avalanche Biotechnologies [now Adverum]; Menlo Park, California), a recombinant adeno-associated virus vector carrying an anti-VEGF protein that was injected into the study eyes of 32 patients to spur expression of the protein in the epithelium. After a year, patients gained an average of just 2.2 letters, experienced increased CRT and required a high number of antiVEGF rescue injections.

“That was an attempt to insert genes into the photoreceptors of the RPE and into the outer retina in order to try to get them to overproduce a soluble VEGF receptor,” Dr. Stewart explains. “Unfortunately, they failed to get really good results.”

‘’Why that wasn’t successful is still not really known: It may be because of where it was injected. It may be because of the amount of protein production. But I think that gene therapy will definitely have a role in the future,” says Dr. Dugel.

Genzyme (Framingham, Massachusetts) is investigating stopping the progression of AMD with a genetically modified adeno-associated virus vector. (ClinicalTrials.gov Identifier: NCT01024998), as is Regenxbio (Rockville, Maryland) (ClinicalTrials. gov Identifier: NCT03066258).

Dr. Dugel and Dr. Stewart say that ophthalmologists have been “spoiled” by the success of currently available anti-VEGF treatments. But Dr. Dugel says there’s still ample room for improvement. “In almost all studies that go on past five years, unfortunately, even with treatment, vision tends to gradually decline to less than baseline. That’s due to macular atrophy and fibrosis,” he says, adding that most newly diagnosed patients can anticipate 15 or 20 years of life after the diagnosis of neovascular AMD.

“I’m disappointed,” admits Dr. Stewart. “Of course, I’ve been elated by the fact that we have anti-VEGF therapy. That has been a game changer for patients and physicians. We had three great successes in a row with Avastin, Lucentis and Eylea. And then all of a sudden, we hit a brick wall. So unless we see a dramatic improvement in duration of action or patient comfort, I think most of us will probably just stay with injections,” he concludes. REVIEW

Dr. Dugel has interests in Genentech, Regeneron, Novartis, Allergan, Chengdu Kanghong Biotechnologies, Graybug Vision, Santen, Opthea, Alcon and Avalanche. Dr. Stewart reports no relevant interests. Dr. Kaiser has interests in Regeneron, Allergan, Alcon, Bayer HealthCare, Chengdu Kanghong Biotechnologies, Novartis and Genentech. Dr. Sharma reports consultancy to and speaker’s fees from Novartis India, Allergan India and Bayer India.

1. Heier JS, Brown DM, Chong V, et al. Intravitreal aflibercept (VEGF Trap-Eye) in wet age-related macular degeneration. Ophthalmology 2012;119:12:2537-2548.

2. Ohji M,Okada AA,Takahashi K, Kobayashi M, Terano Y. Two different treat and extend dosing regimens of intravitreal aflibercept for wAMD in Japanese patients: 52-week results of the ALTAIR Study. Barcelona: Euretina Meeting; 2017.

3. Dugel PU, Jaffe GJ, Sallstig P, et al. Brolucizumab versus aflibercept in participants with neovascular age-related macular degeneration: A randomized trial. Ophthalmology 2017;124:1296-1304.

4. Jaffe G, Koh AHC, Ogura Y, et al. Phase III studies of brolucizumab versus aflibercept in nAMD: 48-week primary and key secondary outcomes from HAWK/HARRIER. Invest Ophthalmol Vis Sci 2018; ARVO e-Abstract 1624. Presented at the ARVO 2018 Annual Meeting; 30 April 2018; Honolulu, HI.

5. Dugel PU, et al. A comparison of the anatomical efficacy of brolucizumab and aflibercept in neovascular age-related macular degeneration (nAMD); An analysis over 16 weeks of matched treatment in the HAWK and HARRIER studies. Paper presented at the ARVO 2018 Annual Meeting; 30 April 2018; Honolulu, HI.

6. Cui J, Sun D, Lu H, et al. Comparison of effectiveness and safety between conbercept and ranibizumab for treatment of neovascular age-related macular degeneration. A retrospective case-controlled non-inferiority multiple center study. Eye 2018;32:391-99.